The majority of good shares in India trade at a share price between Rs 100 to 5000 per share on Indian stock exchanges. However, a few stocks are trading at a price higher than 5000 INR per share. Here we have compiles the list of seven companies with the highest share price in India.

Frankly, the company’s share price has nothing to do with the company’s value; The companies with higher share value can also be undervalued, and the companies with lower share prices can also be overvalued. It is pretty challenging for an investor with limited capital to take positions in such companies; hence, the companies with high share prices are usually less volatile and liquid.

This article will discuss the most expensive shares in India, i.e., the companies with the highest share price in India. Here, we’ll look at the costliest shares in India based on the current share price they are trading in the market.

Note: Please study the companies with care if you want to invest in any of the stocks mentioned in the list here. A high stock price doesn’t guarantee a fundamentally strong company or a good investment. And vice versa. Let’s get started.

7 Companies with the Highest Share Prince in India

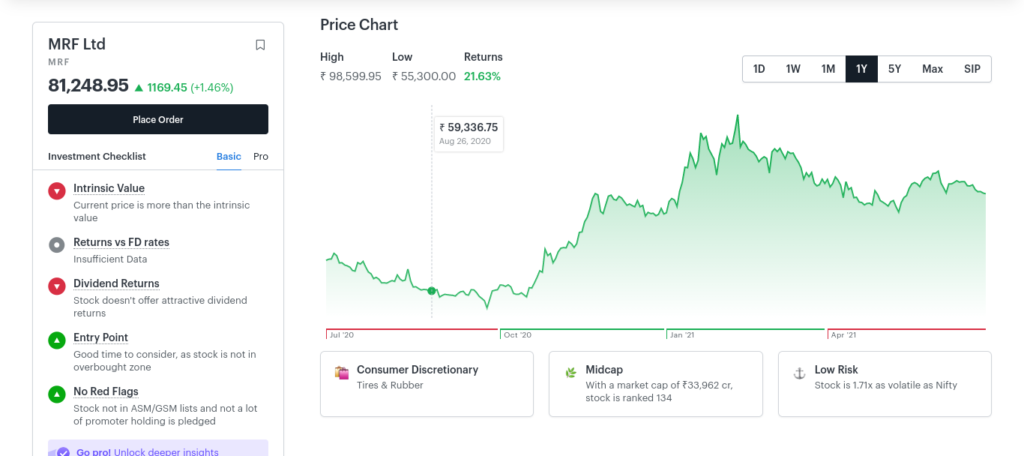

1. MRF (INR 80,079.50)

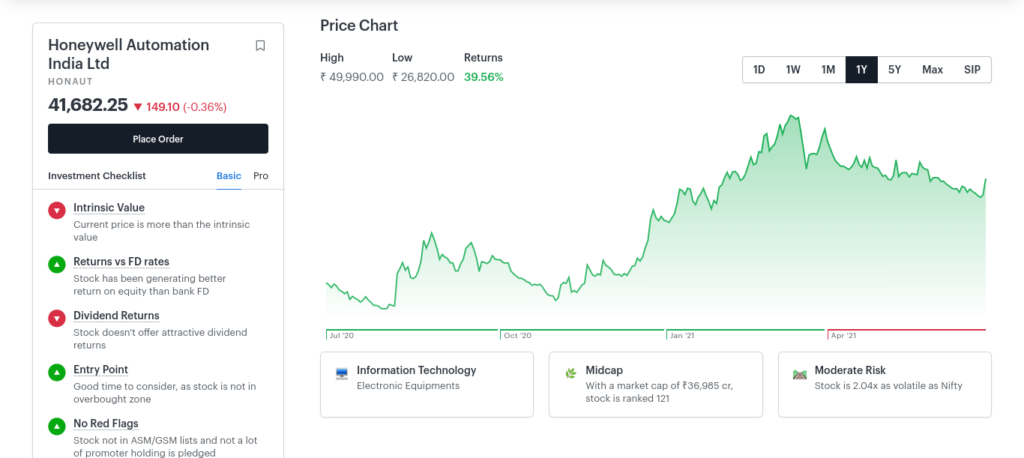

2. Honeywell Automation (INR 41,831)

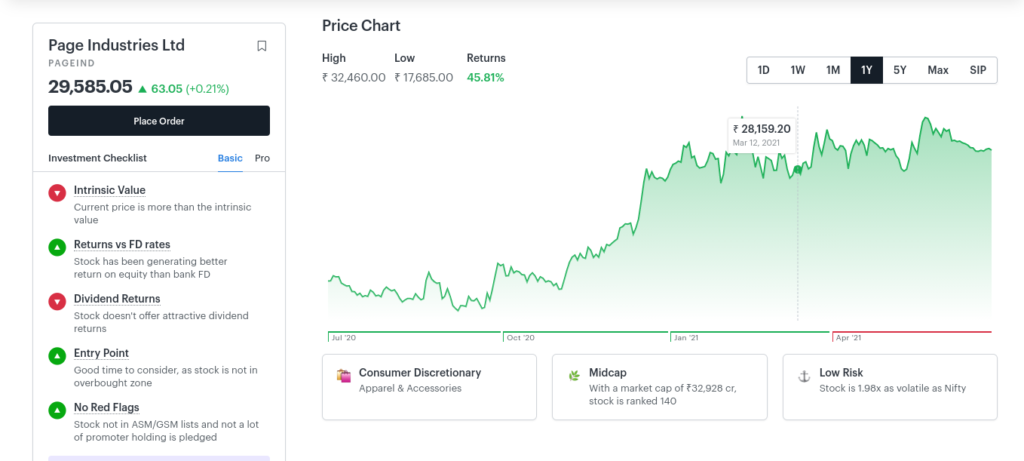

3. Page Industries (INR 29,522)

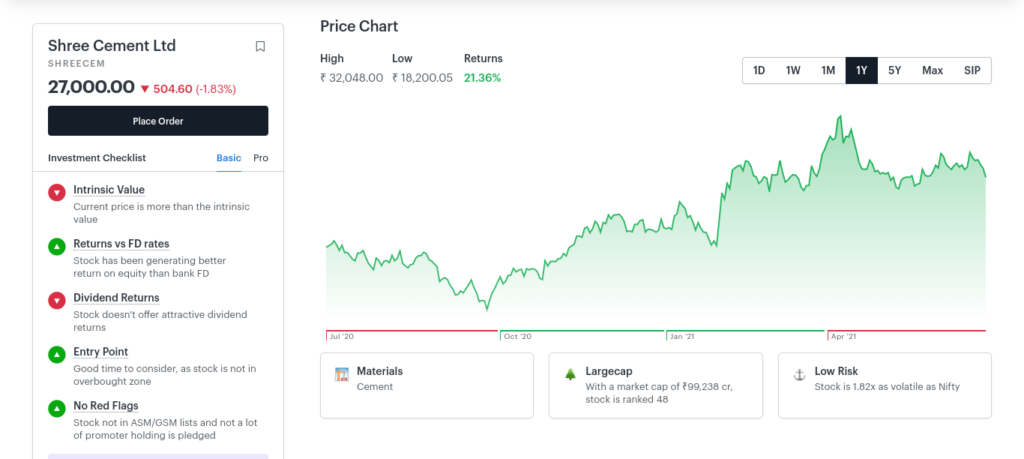

4. Shree Cements (INR 27,504.60)

5. 3M India (INR 24,331.55)

6. Nestle India (INR 16,458)

7. The Yamuna Syndicate (INR. 14,980)

MRF (INR. 80,079.50)

MRF has a Market Valuation of around 36,279 Cr INR

Madras Rubber Factory (MRF) is a leading Tyre manufacturer in India that produces a wide range of tires. It specializes in Car & bike tires, trucks/bus tires, etc.

The MRF shares currently trading at 80079.50 INR are the costliest among all the companies listed in BSE and NSE. The all-time high of MRF share is 98,599.95 INR and has a PE ratio of 26.59.

MRF has never split its share and has a face value of 1 INR. MRF has given 19% return in the last 1 Year.

Honeywell Automation (INR. 41,831)

Honeywell Automation India Limited has a market cap of INR 36,985.28 Cr.

Honeywell Automation India Ltd is a subsidiary of Honeywell group, based in the USA. Honeywell Automation India Limited is engaged in the manufacture of electronic systems and components, repair and maintenance, and trading of machinery, equipment, and supplies. The Company operates through the Automation & Control Systems segment.

The current share price of 41,831.35 INR is the second costliest share traded in the Indian stock market. Since last year, the Company has given returns of around 39.31 % and has a PE ratio of 80.40 and PB ratio of 16.98 compared to sector PE of 33.23.

Page Industries (INR. 29,522)

Page Industries has a market cap of INR 32,928.47 Cr.

Page Industries Limited is engaged in the business of manufacturing and trading garments. The Company offers knitted garments.

Page Industries is currently trading at a PE of 96.68 and a PB ratio of 5.43.

Shree Cements (INR. 27504.60)

Shree Cement has a Market cap of INR 99,238.65 Cr. The current stock price is 27504.60 INR.

Shree Cement Limited is a cement company whose primary products/services are cement and clinker.

Shree Cement has given a 19.32 % return this year and is trading with a PE ratio of 43.41 and a PB ratio of 7.49.

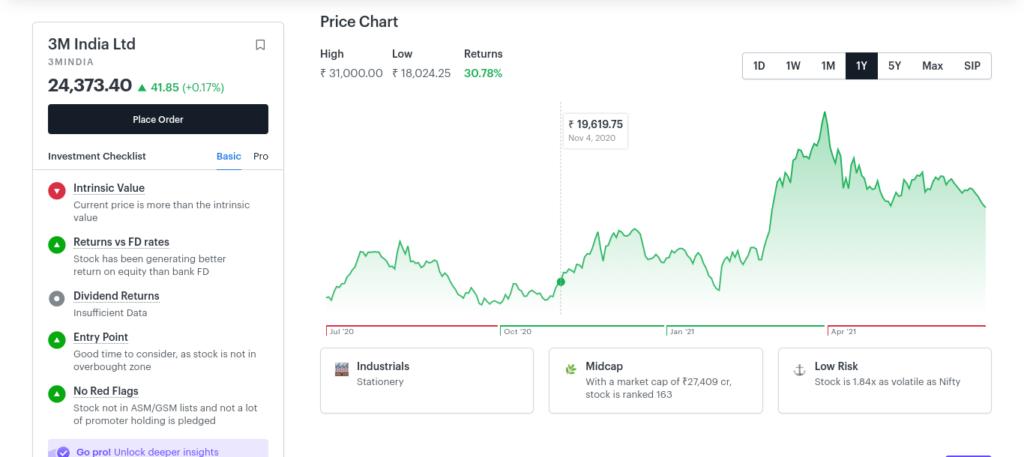

3M India (INR. 24,331.55)

3M India Limited has a market cap of INR 27409.66 Cr. The current stock price is 24,331.55 INR.

3M India Limited is a technology company that works across various segments like industrial, packaging, healthcare, safety, graphics, and consumers.

3M India Limited has given a 29.46 % return this year and is trading with a PE ratio of 168.79 and a PB ratio of 15.65.

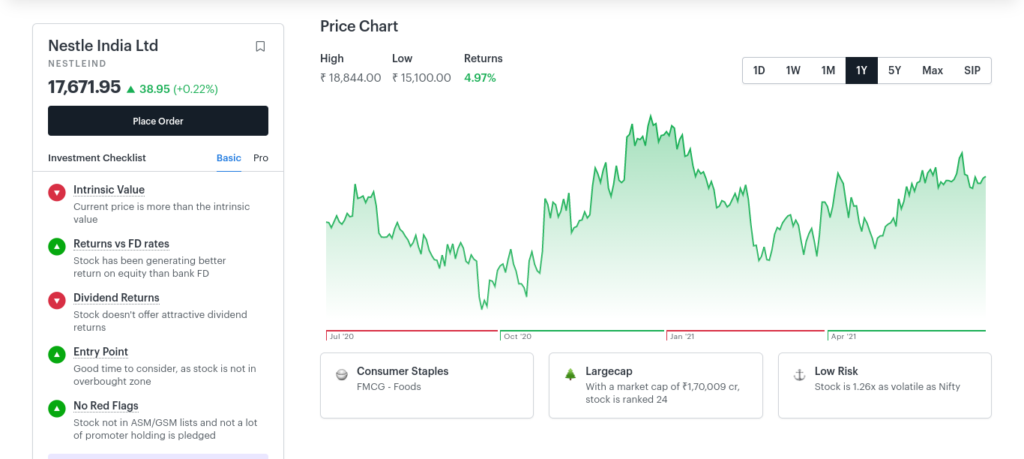

Nestle India (INR. 16,458)

Nestle India Ltd has a market cap of INR 1,70,009.83 Cr. The current stock price is 17,633.00 INR.

Nestle India Limited is engaged in the food business. It manages brands like NESCAFE, MAGGI, KitKat, Barone, Alpino, Munch, Eclairs, and POLO.

Nestle India Ltd has given a 2.66 % return this year and is trading with a PE ratio of 81.64 and a PB ratio of 84.19.

The Yamuna Syndicate Ltd. (INR. 14,980)

Yamuna Syndicate Limited has a market cap of INR 528.64 Cr. The current stock price is 17,199.00 INR.

Yamuna Syndicate Limited is engaged in the trading of petroleum products, batteries, and agrochemical products.

Yamuna Syndicate Limited has given a 97.64 % return this year and is trading with a PE ratio of 4.56 and a PB ratio of 0.59.

Over To You

The stock market is dynamic and hence the list may change even tomorrow. The blog was written on 01/07/2021 and the data provided is the latest figure available. Hope you liked our article. Do comment below if you feel which company will replace these existing ones. Thank you for reading, Happy Investing.

For similar articles, visit Seben Capital Website; you may find the best information on Capital Market, Insurance, Credit Repair, and Loan services. Also, follow us on Instagram and join our Telegram channel.