Financial planning is crucial to ensure your family is financially secure and can achieve their financial goals. An innovative financial plan can help you manage your income, expenses, savings, and investments effectively. This report will discuss how you can create an innovative financial plan for your family.

Understanding Your Family’s Financial Goals

Before you start creating a financial plan, it’s essential to understand your family’s financial goals. Some specific financial goals include:

- Paying off debts

- Saving for retirement

- Saving for education

- Buying a home

- Building an emergency fund

Once you identify your family’s financial goals, you can prioritize them and create a plan to achieve them.

Assessing Your Current Financial Situation

The next step is to assess your modern financial situation. You must determine your family’s income, expenses, debts, and assets. You can use budgeting tools or consult a financial advisor to assess your financial situation accurately.

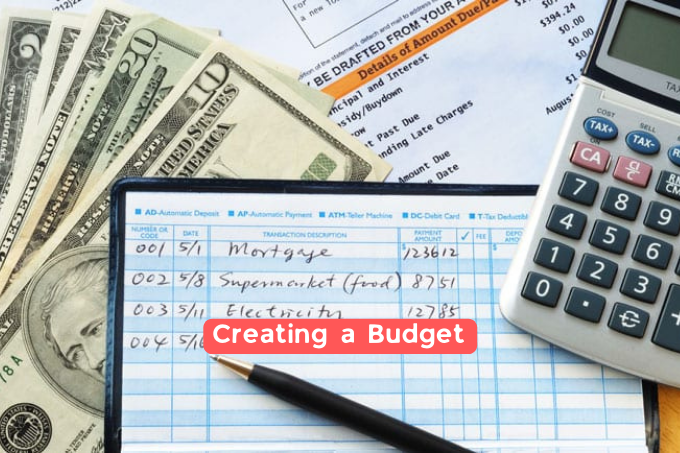

Creating a Budget

An allocation is an essential tool for managing your finances effectively. It helps you allocate your income towards expenses, savings, and investments. To create a budget, you need to:

- List down all your income sources.

- List down all your expenses.

- Categorize your expenses (fixed and variable)

- Determine your savings and investment goals.

- Allocate your income towards expenses, savings, and investments.

You must ensure that your expenses do not exceed your income and that you allocate enough funds toward savings and investments.

Managing Your Debts

Debts can be a significant financial burden and impact your family’s financial goals. You need to manage your debts effectively to achieve your financial goals. Some tips for managing your debts include:

- Pay off high-interest debts first.

- Consolidate your debts if possible.

- Avoid taking on new debts.

- Negotiate with creditors for better payment terms.

Building an Emergency Fund

An emergency fund is crucial to deal with unpredictable expenses such as medical bills, car repairs, or job loss. You must save enough to cover at least six months of your family’s expenses.

Investing for Your Family’s Future

Investing can assist you in growing your wealth and achieving your financial goals. You need to invest wisely and diversify your investments to minimize risk. Some standard investment options include:

- Stocks

- Bonds

- Mutual Funds

- Real Estate

You must consult a financial adviser to determine the best investment options based on your family’s financial goals and risk tolerance.

Reviewing Your Financial Plan Regularly

Creating an economic plan is not a one-time activity. You need to review your financial plan regularly and make adjustments as necessary. You must ensure your financial plan aligns with your family’s evolving financial goals and circumstances.

Conclusion

Creating a brilliant financial plan for your family can help you achieve economic security and reach your goals. It requires careful planning, budgeting, debt management, emergency fund building, and investment strategies. Following the steps summarized in this article, you can create a financial that aligns with your family’s financial goals and circumstances.

FAQs

1. What is a financial plan?

A financial plan is a comprehensive document that outlines your family’s financial goals, income, expenses, debts, assets, savings, and investment strategies.

2. Why is financial planning important for families?

Financial planning is essential for families as it helps them effectively manage their income, expenses, debts, savings, and investments. It also helps them achieve their financial goals and prepare for unexpected expenses.

3. How do I create a budget for my family?

To create an allocation for your family, list all your income sources, expenses, savings, and investment goals. Then, you must allocate your income towards expenses, savings, and investments while ensuring that your expenses do not exceed your income.

4. What is an emergency budget, and why do I need it?

An emergency budget is a savings account that you can use to cover unpredictable expenses, such as medical bills, car repairs, or job loss. You need an emergency fund to avoid taking on debt during financial emergencies.

5. Can I create a financial plan independently, or do I need a financial advisor?

You can create an economic plan on your own, but it’s recommended to consult with a financial advisor, especially if you have complex financial goals or investment strategies. A commercial advisor can assist you in making a comprehensive financial plan that aligns with your family’s financial goals and circumstances.