Table of Contents

Gambling is staking something on a contingency — wagering money on something with an uncertain and potentially negative outcome. However, when trading is considered, gambling takes on a much more complex dynamic than the definition presents. Many traders are gambling without knowing it — trading in a way or for a completely dichotomous reason with success in the markets.

In this article, we will examine the hidden ways in which gambling creeps into trading practices and the stimulus that may drive an individual to trade (and possibly gamble) in the first place.

KEY TAKEAWAYS

- There are two common traits in those who exhibit gambling tendencies when trading.

- If a person trades for excitement or social proofing reasons rather than in a systematic way, they are likely trading in a gambling style.

- If a person trades only to win, they are likely gambling. Traders with a “must-win” attitude often fail to recognize a losing trade and exit their positions.

Hidden Gambling Tendencies

It is quite likely that anyone who believes they don’t have gambling tendencies will not happily admit to having them if it turns out they are acting on gambling impulses. Yet discovering the underlying motives behind our actions can help us change our future decisions.

Before delving into gambling tendencies when trading, one tendency is apparent in many people before trading occurs. This same motivator continues to impact traders as they gain experience and become regular market participants.

Social Proofing

Some people may not be interested in trading or investing in the financial markets, but social pressure induces them to trade or invest. This is especially common when many people talk about investing in the markets (often during the final phase of a bull market). People feel pressure to fall in line with their social circle. Thus, they invest to avoid disrespecting or disregarding others’ beliefs or feeling left out.

Making some trades to appease social forces is not gambling in and of itself if people know what they are doing. However, entering into a financial transaction without a solid investment understanding is gambling. Such people lack the knowledge to control their choices’ profitability.

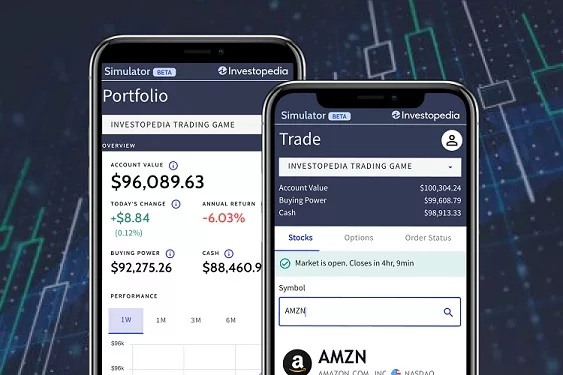

Investopedia Essentials

Try the Investopedia stock Simulator.

See which online brokers provide speed and reliability at a low cost. We’ve broken down the pros and cons of each to help you make the best decision for your day trading needs.

Many variables exist in the market, and misinformation among investors or traders creates a gambling scenario. Until knowledge has been developed that allows people to overcome the odds of losing, gambling occurs with each transaction.

Important: If you or someone you know has a gambling problem, call the National Council on Problem Gambling Helpline at 1-800-522-4700 or visit NCPGambling.org/Chat to chat with a helpline specialist.

Contributing Gambling Factors

Once someone is involved in the financial markets, a learning curve may seem like gambling based on the social proofing discussion above. This may or may not be true based on the individual. How the person approaches the market will determine whether they become a successful trader or remain a perpetual gambler in the financial markets.

The following two traits (among many) are easily overlooked but contribute to gambling tendencies in traders.

Gambling (Trading) for Excitement

Even a losing trade can stir emotions and a sense of power or satisfaction, especially regarding social proofing. If everyone in a person’s social circle is losing money in the markets, losing money on trade will allow that person to enter the conversation with their own story.

When people trade for excitement or social proofing reasons, they are likely trading in a gambling style rather than in an organized and tested way. Trading the markets is exciting—it links the person to a global network of traders and investors with different ideas, backgrounds, and beliefs. Yet getting caught up in the “idea” of trading, the excitement, or emotional highs and lows, is likely to detract from acting systematically and methodically.

FAST FACT

Speculation involves making a risky investment but one with a positive expected return. The player’s expected return for gambling is always negative, even though some may get lucky and win in the short run.

Trading to Win and Not Trading a System

Trading methodically and systematically is important in any odds-based scenario. Trading to win is the most obvious reason to trade. After all, why trade if you can’t win? However, there is a hidden detrimental flaw regarding this belief and trading.

While making money is the desired overall result, trading to win can drive us further from making money. If winning is our prime motivator, the following scenario is likely to play out:

Taylor buys a stock they feel is oversold. The stock continues to fall, placing Taylor in a negative position. Instead of realizing the stock is not simply oversold and that something else must be going on, Taylor continues to hold, hoping the stock will return so they can win (or at least break even) on the trade. The focus on winning has forced the trader into a position where they don’t get out of bad positions because to do so would be to admit they lost.

Good traders take many losses—they admit they are wrong and keep the damage small. Not having to win on every trade and taking losses when conditions indicate they should allows them to be profitable over many trades. Holding losing positions after original entry conditions have changed or turned negative means the trader is now gambling and no longer using sound trading methods (if they ever were).

FAQs

1. Is Investing Gambling?

Ans: Investing involves committing capital to an asset, like a stock, and expecting to generate income or profit. Gambling, on the other hand, involves wagering money on an uncertain outcome that is statistically likely to be negative. A gambler owns nothing, while an investor owns a share of the underlying company.

2. Is Gambling a Smart Way to Make Money?

Ans: Statistically, gambling is not a smart way to make money. The odds are against the gambler, with the house having a built-in mathematical advantage that grows over time. While winning a big payout or mitigating risk through selective playing based on research and odds is possible, most gamblers will lose money overall.

3. Is It Better to Invest Than Gamble?

Ans: While both involve minimizing risk to reap rewards, an investor’s odds are generally better than a gambler’s. That’s because, with gambling, the house has an edge, a statistical advantage over the gambler that grows the longer the person is playing. A gambler can still strike it big, but it’s more likely the person will ultimately lose. Investing can yield great losses, but the stock market generally appreciates over time. If you keep investing, the odds are generally in your favor, certainly more so than for a gambler.

The Bottom Line

Gambling tendencies run far deeper than most people initially perceive and well beyond the standard definitions. Gambling can take the form of needing to prove oneself socially or acting to be socially accepted, resulting in taking action in a field one knows little about.

Gambling in the markets is often evident in people who do it mostly for the emotional high they receive from the excitement and action of the markets. Finally, relying on emotion or a must-win attitude to create profits—rather than trading in an organized and tested system—indicates the person is gambling in the markets and unlikely to succeed throughout many trades.

Trade on the Go. Anywhere, Anytime

One of the world’s largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You’ll also have access to Binance tools that make it easier to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.