Investing is similar to hedge funds but at a lower price.

We carefully study and suggest top products and services on our own. Check out our advertiser disclosure to understand how we do this and who we work with. When you buy through our links, we may earn commissions.

:max_bytes(150000):strip_icc():format(webp)/Titan_logo-508be0f26f2d4d8284707b710e6e635f.jpeg)

OVERALL RATING

FAST FACTS

Account Minimum: $500

Fees: Automated portfolios have a 0% fee, while active portfolios charge between 0.7% and 0.9%.

Table of Contents

Our Take

Robo-investing usually involves answering questions about your risk tolerance, age, and income to build a portfolio that’s invested in funds and adjusted regularly. Titan does this, but they offer more. They give investors access to actively managed funds that aim to beat index funds. Titan also lets customers hedge against its funds’ positions to guard against market downturns. Besides this, Titan offers access to alternative assets like real estate and venture capital, which are usually available only to accredited investors. We’ll look at the pros and cons of Titan’s active approach so you can decide if it’s right for you.

2023 Robo-Advisor Reviews

Overall Star Ratings

Pros & Cons

Pros

- Actively managing stocks

- Access to different kinds of investments

- Protecting your investments

- Advanced Smart Cash Formula

Cons

- Basic robo services have limitations.

- Restricted goal-planning options

- Costly fees

- No tax-saving strategy

Account Overview

| Account Minimum | $500 |

| Fees | No charge for automated portfolios, while active portfolios cost between 0.7% and 0.9%. |

| Goal Setting | Handling cash, investing for the short and long term, planning for retirement |

| Available Assets | Stock and bond funds, mutual funds, private loans, startup investments, digital currency, government bonds, and professionally managed stock investments. |

| Interest Paid on Cash Balances | 3.2% (as of Sept. 8, 2023) |

| Customizable Portfolio | No |

| View Portfolio before Funding | Yes |

| Customer Service | Live chat, virtual chatbot, and email support are available from 9 a.m. to 6 p.m. |

| Financial Advisor Available | Yes |

| Cash Management | Titan Smart Cash, high-interest savings account, regular savings account |

| Tax-Loss Harvesting | No |

| External Account Sinking/Consolidation | Yes |

| Mobile App | Android, iOS |

Account Setup

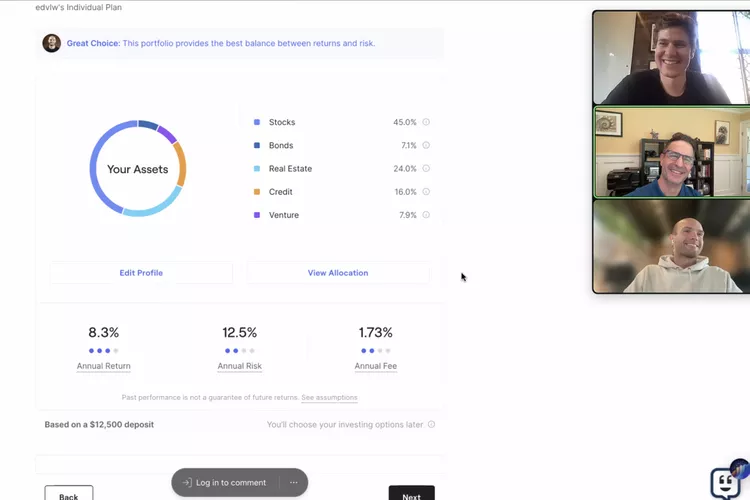

Setting up an account with Titan is like setting up an account with other robo-advisors. First, you’ll provide your address and contact details and then complete a text verification step. Next, you’ll answer some basic questions about yourself, like your age, how much money you have, why you’re opening the account, how long you plan to invest, and how much risk you’re comfortable with. Titan explains why each question is important.

Once you’ve finished entering your information, the system suggests three different investment strategies. These include both traditional and alternative assets. Titan offers three passive and actively managed funds options: a diversified growth portfolio, an automated stocks and bonds portfolio, and a low-risk portfolio. You can also create your custom portfolio.

To start investing with Titan, you’ll need a minimum of $500 for passive and actively managed funds. Passive accounts have expense ratios, while actively managed accounts have extra fees and expenses.

After you decide on your strategy, the rest of the process is similar to other accounts. You’ll fund your account and then start building your portfolio. One great thing about Titan-managed accounts is that they let you trade fractional shares, so you can start investing even if you don’t have much money.

Goal Planning

Goal planning with Titan is restricted. They offer a retirement planning tool that considers your yearly income, current retirement savings, and years until retirement to see if you’re on the right path. However, their planning tools don’t cover big expenses like buying a house, car, or college expenses. However, all clients can use external retirement account analyzers and wealth calculators.

INVESTOPEDIA ROBO-ADVISOR SURVEY

In Investopedia’s 2023 Robo-Advisor Consumer Survey, most people said they’d use robo-advisors to plan big purchases like buying homes, cars, and traveling when asked to pick their top investment goals.

Investors Are Most Likely to Use Their Robo-Advisor to Invest in Large Purchases

Account Services

Many robo-advisors offer different services for their users, like cash management and customization, along with features like charitable giving tools, a focus on diversity, equity, and inclusion (DEI), or environmental, social, and governance (ESG) investing. They also allow users to sync and analyze outside accounts. However, Titan currently only provides some cash management options and not much else.

Cash Management

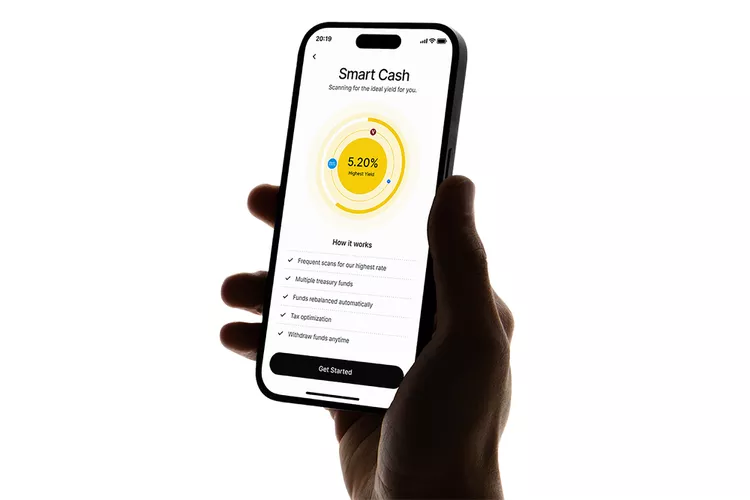

Titan offers a cash management program called Smart Cash, which currently offers an APY of up to 5.31%. The program searches for the best short-term rates across treasury securities to ensure cash is invested at the highest possible rate for a good after-tax interest rate. It also spreads investments across institutions to maximize FDIC protection.

While Smart Cash provides a competitive interest rate, Titan doesn’t provide other cash management tools like checking accounts or bill-paying services. Compared to other robo-advisors, Titan’s cash management options are limited, even though the interest rate through Smart Cash is competitive.

Portfolio Construction

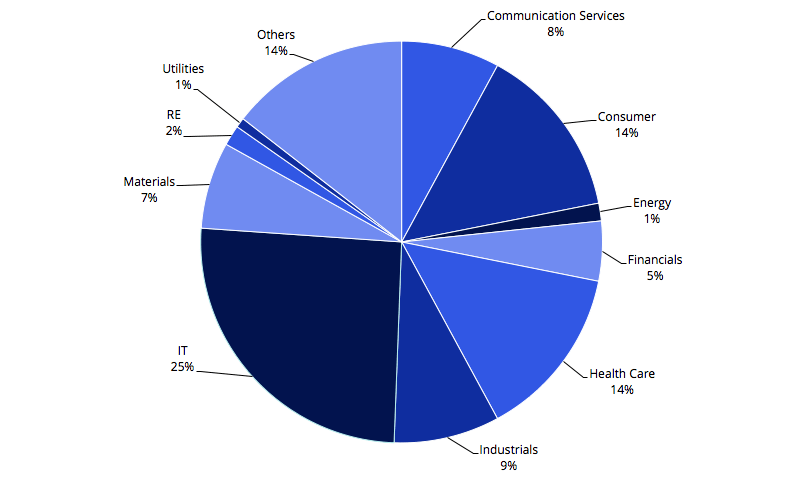

Titan constructs portfolios using modern portfolio theory (MPT) and mean-variance analysis optimization. Passively managed portfolios are rebalanced quarterly based on Titan’s algorithms. Actively managed portfolios, built on the same principles, are managed more flexibly to aim for higher returns than the S&P 500.

In addition to automated stock and bond options, Titan offers investors access to three actively managed portfolios.

- Titan Flagship: A fund that concentrates on big American companies

- Titan Opportunities: A fund seeking growth in small-cap companies

- Titan Offshore: A fund focused on international stocks

Titan offers a cryptocurrency fund that includes Bitcoin and Ethereum exposure.

Titan also offers non-proprietary alternative investment funds like Carlyle Tactical Private Credit, Apollo Diversified Credit, ARK Venture, and Apollo Real Estate. These funds usually require a higher minimum investment compared to Titan’s funds.

Available Assets

| Individual Stocks | No |

| Mutual Funds | Yes |

| Fixed Income | Yes |

| REITs | Yes |

| Socially Responsible or ESG Options | No |

| ETFs | Yes |

| Non-Proprietary ETFs | Yes |

| Private Equity | Yes |

| Forex | No |

| Crypto | Yes |

Portfolio Customization

At Titan, portfolio customization depends on the information each client provides when setting up or managing their account. This includes their investment goals, risk tolerance, and preferred asset classes. Based on this information, Titan suggests suitable portfolio mixes. For actively managed strategies, client inputs influence whether the portfolio will be hedged using inverse ETFs. While portfolios can’t be personalized for each client, specific securities can be excluded based on their preferences.

Portfolio Management

Titan’s actively managed strategies include a hedge customized to each investor’s risk preferences. However, these portfolios aren’t managed for tax-loss harvesting, and there’s no option for directing charitable giving from these accounts.

Titan allows clients to track their progress toward their goals in real time. Another advantage of Titan is that it supports fractional shares, making it easy to invest new funds and dividends quickly into the portfolio.

| Key Portfolio Management Features | |

|---|---|

| Automatic Rebalancing | As needed, triggered by portfolio drift |

| Reporting Features | Statements, tax information |

| Tax-Loss Harvesting | No |

| External Account Syncing/Consolidation | Yes |

User Experience

Desktop

The desktop platform of Titan operates smoothly. It’s a simple website that effectively presents all the important information. You can view the different investment options even without logging in. If you have an account, adding products is easy. The retirement calculators on the desktop are straightforward and user-friendly. While the website doesn’t have a regular search bar, a chatbot and answers function serve that purpose by offering content based on your questions.

Mobile

The mobile platform is similar to the desktop version and lives simple. It’s designed primarily for mobile devices, making the app and place easy to understand and navigate. The app has ratings of 4.4 and 4.6 on Google Play and the Apple App Store, respectively.

Customer Service

- Live chat is available from 9 a.m. to 6 p.m.

- Automated virtual assistant

- Support via email

Customer service at Titan is limited, but potential and current clients can reach out via online chat from 9 a.m. to 6 p.m. Unfortunately, there’s no phone support available. However, Titan’s Investor Relations team, which includes professionals licensed with series 7 and 63, is ready to chat with clients about portfolio building and investment strategies. You can access them through the Titan app, email, or text chat.

While Titan doesn’t offer access to financial planners for long-term strategies or detailed retirement goals, it does integrate with some third-party applications. For example, it connects with Empower (formerly Personal Capital), which provides free financial planning and wealth management services. This service lets users link multiple external accounts, including Titan accounts, to see their financial situation. Although Titan doesn’t integrate with Mint.com directly, accounts at Apex, Titan’s clearing firm, can be linked to Mint.com. Currently, Titan doesn’t integrate with Quicken or any applications related to cryptocurrency positions.

Security

Titan offers standard security measures to keep your accounts safe. This includes encrypted websites and options for two-step authentication or biometrics to ensure secure connections. Your accounts are also covered by SIPC and FDIC insurance. Additionally, Titan uses multiple banks for cash equivalents, providing coverage of up to $5 million under FDIC insurance, which means more of your cash is protected.

The Majority of Robo-Advisor Users Are in Their 20s to 40s

Source: Investopedia’s 2023 Robo-Advisor Consumer Survey (Aug. 30 – Sep. 15, 2023)

Chart: Investopedia

Education

Titan’s website offers educational and research materials, including articles and videos on venture capital, the stock market, and robo-investing. It also provides retirement planning software and calculators for future projections.

However, compared to larger brokerage firms, Titan’s educational resources are not as extensive and may not be unique. While they have some useful content, it’s often free without opening an account. Additionally, their FAQ section is not easily accessible, and some topics don’t have corresponding FAQs.

Commissions and Fees

Titan’s fees depend on your chosen investments, and they’re generally higher than those of traditional robo-advisors. Titan actively manages accounts and offers access to asset classes like venture capital and credit strategies, which are not commonly available with other robo-advisors.

Here are the fees and minimums for different accounts:

- Smart Cash: doesn’t charge management fees and requires a minimum of $5 to start and add more money.

- Titan’s automated strategy accounts: operate similarly to traditional robo-investing accounts by providing a model portfolio and rebalancing without charging management fees. However, investors are responsible for fund expense ratios, which are minimal at 0.039% for “Automatic Stocks” and 0.10% to 0.12% for “Automated Bonds.” While these fees are low, other traditional robo-advisors may offer more portfolios with lower fees and minimum investment requirements.

- Actively managed stock accounts: Titan requires a minimum investment of $500. The management fee starts at 0.90% of your account’s value per year for amounts up to $25,000, then reduces to 0.80% for amounts up to $100,000, and settles at 0.70% for all assets above $100,000. These rates and minimums apply to Flagship, Opportunities, and Offshore actively managed funds and Titan’s crypto and strategy offerings. Compared to traditional robo-advisors, these management fees are higher, but if the performance exceeds the S&P, the higher fees may be justifiable.

Titan offers additional actively managed, non-proprietary funds with different fee structures. For example, the Tactical Private Credit strategy fund requires a minimum investment of $2,000 and has the same 0.90%, 0.80%, or 0.70% Titan management fee based on the account value. Additionally, external managers have a 1% management fee, increasing to 15% once a hurdle rate of 6% is reached. On the other hand, the ARK Innovation Fund has a minimum investment amount of $500, but management fees are higher at 2.75%.

The Bottom Line

Titan works well and is easy to use, but is it right for you? That depends on what you are looking for. Titan can be a solid fit if you want a no-frills robo-advisor with low fees. This is especially true if you want to have some of your portfolio actively managed or if you want access to private equity, real estate, and credit strategies. Titan offers non-accredited investors access to these markets for less than what actual hedge funds charge.

Suppose you are looking for a full-featured robo-advisor experience. In that case, however, Titan can’t compete with the more immersive and customizable experiences at Wealthfront and Betterment or the value for money of a Fidelity Go or Schwab Intelligent Portfolios at lower balance, fee-free tiers.

Regarding Titan’s actively managed strategies, the performance of the investments needs to be high enough to make up for the higher management fees. Returns on Titan’s funds benchmarked against the S&P have outperformed during recent stretches, but Titan’s Flagship Fund has an annualized return of 12.31% since inception on Feb. 20, 2018. This is currently ahead of its benchmark, but there have been some peaks and valleys, as with all active funds.

Final Verdict

Titan is user-friendly and effective, but whether it’s right for you depends on your preferences. Titan may not be the ideal choice if you’re seeking a basic robo-advisor with low fees. However, Titan could be suitable if you prefer actively managed and hedged portfolios or want access to private equity, real estate, and credit strategies. It provides access to these markets for non-accredited investors at a lower cost than actual hedge funds.

Regarding performance, Titan’s actively managed strategies must generate high returns to offset the higher management fees. While returns on Titan’s funds compared to the S&P were strong in the first half of 2023, the Flagship Fund returned 10.62% relative to the S&P 500’s 11.33% since its inception on February 20, 2018.

FAQs

1. Is It Safe to Use Titan to Invest?

Ans: Yes, Titan is a secure platform to use. The company is registered with the SEC and has a good reputation. However, the safety of the company and its assets doesn’t guarantee the safety of the investments. Titan offers a variety of investment options, from traditional ETF portfolios to exposure in other markets like private equity and real estate, which can lead to different investment outcomes.

2. Is Titan FDIC Insured?

Ans: The Titan cash product offers a higher-yield savings option with up to $250,000 in FDIC insurance. Customers enrolled in Titan’s Cash Sweep program can receive up to $5 million in FDIC insurance by utilizing partner banks to invest their cash.

For investment accounts, standard SIPC protection against brokerage firm failure covers up to $500,000, with a maximum of $250,000 in cash.

3. What Is the Minimum You Can Invest With Titan?

Ans: The minimum investment amount at Titan Invest varies depending on the investment option. For the Smart Cash product, you only need $5 to get started. Automated and actively managed accounts have a minimum investment of $500, while certain specialty funds require at least a $2,000 investment.

4. Who is Titan’s CEO?

Ans: Clayton “Clay” Gardner and Joe Percoco are co-CEOs and founders of Titan, while their partner, Max Bernardy, graduated from Stanford. They all met while studying at prestigious universities like Wharton and Stanford. Before starting Titan, they worked at hedge funds and large banks. They realized that smaller investors should have access to the same trading strategies used by hedge funds. Gardner focuses on creating portfolios and managing active investment strategies for Titan.

How We Review Robo-Advisors

Providing readers with unbiased, comprehensive reviews of digital wealth management companies, more commonly known as robo-advisors, is a top priority of Investopedia. We used our 2023 consumer survey to guide the research and weightings for our 2024 robo-advisor awards. To collect the data, we sent a digital survey with 64 questions to each of the 21 companies we included in our rubric. Additionally, our team of researchers verified the survey responses and collected any missing data points through online research and conversations with each company directly. The data collection process spanned from Jan. 8 to Feb. 9, 2024.

We then developed a quantitative model that scored each company to rate its performance across nine major categories and 59 criteria to find the best robo-advisors. The score for each company’s overall star rating is a weighted average of the criteria:

- Account Services: 10.00%

- Account Setup: 5.00%

- Customer Service: 5.00%

- Fees: 15.00%

- Goal Planning: 21.00%

- Portfolio Contents: 17.00%

- Portfolio Management: 17.00%

- Security & Education: 5.00%

- User Experience: 5.00%

Additionally, during our 2023 research, many of the companies we reviewed granted our team of expert writers and editors access to live accounts so they could perform hands-on testing.

Investopedia has provided you with an unbiased and thorough review of the top robo-advisors through this all-encompassing data collection and review process.

Read more about how we research and review robo-advisors.

Separately, our research team surveyed 205 U.S. adults aged 18 to 72 who are current clients of one of 18 robo-advisors. While the information collected did not influence the development of our rating model, it was instrumental in gathering the valuable insights published in Investopedia’s 2023 Robo-Advisor Consumer Survey.

Participants in our 2023 Robo-Advisor Survey opted for an online, self-administered questionnaire from a market research vendor. Data collection occurred between Aug. 30 and Sept. 15, 2023, with 11 video interviews conducted with volunteer respondents from Sept. 7 to Sept. 17, 2023. Multiple quality checks, including screeners, attention gauges, comprehension evaluations, and logic metrics, were used to ensure only the highest quality responses were included.

Methodology

Investopedia prioritizes giving readers honest, detailed reviews of digital wealth management companies, commonly known as robo-advisors. Our team spent over two months thoroughly researching and evaluating 19 robo-advisor platforms. This involved deep industry research, collecting data from company surveys, and testing each platform firsthand.

We created a scoring system based on nine main categories and 57 criteria to rate the performance of each company. The overall star rating for each company is a weighted average of these criteria.

We conducted live demonstrations with many companies and were granted access to live accounts for hands-on testing by expert writers and editors. Our goal was to provide an unbiased and comprehensive review of the top robo-advisors.

Additionally, we surveyed 205 U.S. adults aged 18 to 72 who are current clients of one of 18 robo-advisors. This survey, conducted online with quality checks to ensure accuracy, provided valuable insights for our 2023 Robo-Advisor Consumer Survey, published separately.

Our rigorous review process aims to give readers the most accurate and helpful information about robo-advisors to aid decision-making.

Titan

Trade on the Go. Anywhere, Anytime

Get ready to trade on one of the biggest crypto exchanges worldwide! Binance offers low fees and great customer support to ensure safe trading. With Binance tools, you can easily track your trade history, manage auto-investments, check price charts, and convert currencies with no fees. Signing up is free, so join millions of traders and investors in the global crypto market today!