Table of Contents

Innovative social trading and growing asset lineup

We publish unbiased product reviews; our opinions are our own and are not influenced by the payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

:max_bytes(150000):strip_icc():format(webp)/eToro-logo-20d30156718947bcab27419d63c29ff3.jpg)

FAST FACTS

Account Minimum: $100 for stocks and ETFs, $200 for CopyTrader

Fees: 1% crypto trading fee, no-fee stock, ETF, and options trading

TABLE OF CONTENTS

- Our Take

- Pros & Cons

- Trade Experience

- Order Types

- Costs

- Portfolio Analysis

- Customer Service

- Transparency

- Final Verdict

- Introduction

- Usability

- Range of Offerings

- Trading Technology

- Account and Research Amenities

- Education

- Security and Reliability

- Available Account Types

Tip: For a limited time, you can earn a bonus of $10 when you deposit at least $100 in your eToro account. This promotion is in select U.S. states. Terms & conditions apply.

Our Take

eToro offers an innovative trading platform highlighted by a unique social trading experience. With eToro’s social trading network, users can explore and copy the trades of more experienced investors for crypto, stock, and ETF assets. The platform shines with an intuitive site design so investors can easily discover traders they’d like to follow or quickly place their trades on the platform.

eToro operates in more than 140 countries, underscoring the platform’s ability to appeal to diverse users. eToro is available to most but not all investors in the United States. Although eToro has recently added an app for options trading for U.S. customers only, its platform still lacks many of the tools. It features typical of more comprehensive trading experiences, limiting the platform’s usefulness to more sophisticated investors. The service is best aligned with traders who want a social and crypto focus, but traders seeking more than this will likely find alternative online brokers better suited to them.

Warning: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This article does not recommend that Investopedia or the writer invest in cryptocurrencies, and the accuracy or timeliness of the information cannot be guaranteed.

- On Nov. 29, 2023, eToro announced the launch of an interest-on-cash feature. Available to eToro Options account holders, the new opt-in program offers 4.9% APR on cash balances and is free for eligible users with an at-rest cash balance of $5,000 or more. Users who opt into the program and maintain less than $5,000 at rest in their account will still benefit from the offering but will be charged a small monthly fee.

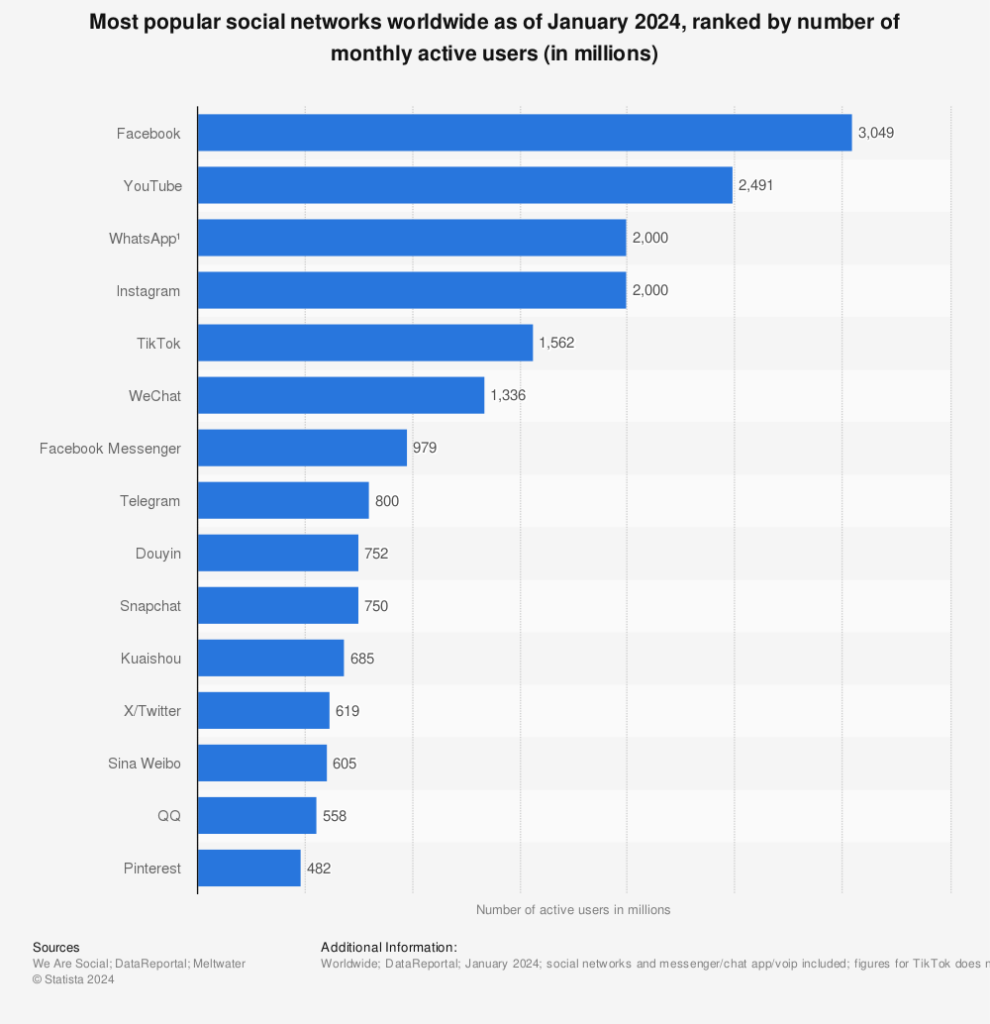

- In 2023, eToro recently announced a deal to allow X (formerly Twitter) users to purchase assets mentioned on X through eToro.

Introduction

eToro was launched in Israel in 2007 by three entrepreneurs. The platform originally focused on forex trading but quickly found traction to expand its product lineup and grow into a global service. In 2010, eToro created one of the first social trading experiences, OpenBook, enabling users to learn from and copy other seasoned traders. The platform continued to show its innovative nature by expanding its services to include stock trading, ETFs, automated portfolios, crypto, and cash management features. eToro recently added options trading to its platform. eToro now operates in more than 140 countries worldwide, boasting over 20 million users.

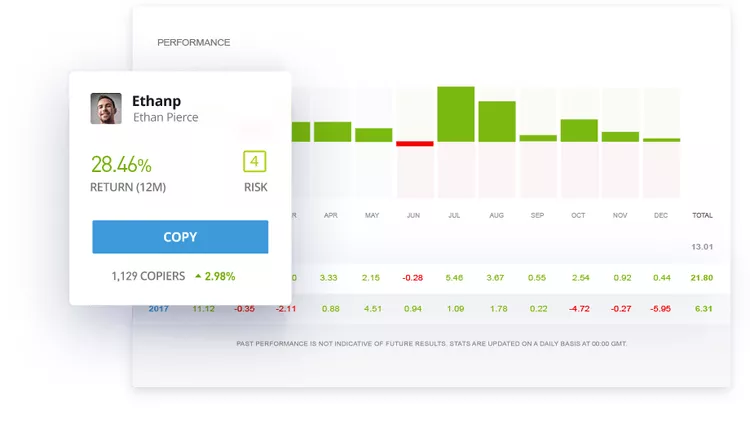

The company’s flagship offering is the social investing feature, CopyTrader. Users can quickly find investors to follow and copy trades based on investor star ratings, coin interests, and performance metrics. With a minimum investment of $200 for this dynamic, traders can copy up to 100 investors simultaneously. This feature is only available for crypto.

eToro announced expanded offerings in the U.S. in January 2022, launching support for stock and ETF trading. In addition, the company launched options trading in November 2022. eToro. “Explore New Options With Options.”

The U.S. version of the platform now includes these assets and crypto combined with the social trading experience. eToro’s cash management service, eToro Money, and the automated portfolio management service Smart Portfolios are also available in the United States. While the platform is available in more than 40 states, eToro is unavailable to everyone nationwide.

Every user of eToro is given a $100,000 paper trading account so you can learn more about the market and test different trading strategies before risking your own money. This makes it easier for beginner investors, in particular, to enter the market. An educational section lets users learn more about investing and trading. However, the range of topics is limited, and material on financial guidance and goal planning is lacking. Tools, calculators, and research functionality are limited as well. A narrow range of available asset types is restricted to 3,000 stocks and over 300 ETFs. Important trading functionality like margin accounts is absent altogether.

Pros & Cons

Pros

- Established, global platform

- Innovative and easy-to-use social trading experience

- Support for fractional shares

- eToro Money cash management service

Cons

- Only available in 46 U.S. states

- Relatively limited ETF and stock selections

- Limited account types

- General lack of advanced trading tools, features, and research

Pros Explained

- Established, global platform: eToro’s established, global platform appeals to millions of users. While the U.S. platform is more limited than international versions, eToro has a product offering that resonates with users from all backgrounds.

- Innovative and easy-to-use social trading experience: CopyTrader lets you quickly leverage expertise from other investors. You can evaluate traders based on user ratings and performance metrics to ensure you follow a trading strategy that aligns with your goals.

- Support for fractional shares: This gives traders more flexibility to access more expensive investments with less money, keeping more of their portfolio invested.

- eToro Money cash management service: This feature gives you more control over your finances by letting you manage more money in one place. You can store crypto, deposit and withdraw funds, and send and receive money easily.

Cons Explained

- Only available in 46 U.S. states: The platform has slowly been expanding its reach across the country, but residents of New York, Nevada, Hawaii, and Minnesota can’t use eToro. The virtual portfolio demo account is open to investors in all states.

- Relatively limited ETF and stock selections: These constraints hurt the platform’s appeal to traders beyond the intermediate level. With 3,000 stocks and over 300 ETFs, some investors will feel left out and unable to pursue their desired trading strategy.

- Limited account types: Users can only open brokerage accounts because retirement and other accounts are unavailable.

- There is a general lack of advanced trading tools, features, and research. Without these, more sophisticated investors can’t execute complex trading strategies.

Usability

eToro has a straightforward, simple design that makes it easy for traders to find what they want. The app and website experience provide similar functions and features, so users can seamlessly transition to trade through their preferred version. The new eToro Options platform is also easy to use.

The CopyTrader tool lets you quickly search for and copy the crypto trades of popular investors. Traders can engage with other platform members through the Popular Investor Program, which facilitates the sharing of trading insights and knowledge. Popular Investor Program members are compensated the more copiers they have. Payouts can reach up to 2% of a trader’s assets on the platform.

A social news feed adds another interactive element to the experience, with the site functioning like a distinct social media feed. Trading decisions and news can also be shared on external social media sites like Facebook and X.

While these features combine to make a unique, interactive trading experience, the inability to short positions in the U.S. limits Popular Investor Program trading strategies. CopyTrader is also only available to trade cryptocurrency, as ETF and stock trading aren’t included in this feature.

eToro makes it easy to search for and transact ETFs and stock trades. However, the limited number of assets available to trade inherently reduces the impact of the available filters and financial tools. Users of eToro can quickly see an asset’s performance metrics and view historical charts that help them visualize trends. However, the level of detail available leans more on the basic side.

Trade Experience

eToro provides a streamlined onboarding process with a self-guided questionnaire asking for personal information to help set up your account. The platform supports various financial institutions you can link to eToro to deposit into your account. Getting up and running doesn’t take long, and you can begin trading quickly. It is also easy to set up an eToro Options account, which lets you trade options in the eToro Options app.

A “Trading” tab lets you view prices and buy, sell, or convert crypto, ETFs, or stocks. Prices are provided in real-time. There is a limited menu of assets that you can trade, as eToro offers 25 cryptocurrencies, 3000 stocks, and over 300 ETFs. Users won’t find many order types beyond basic market and limit orders, which prevents more complex traders from getting the most out of the system.

The flagship CopyTrader and Popular Investor Program features are the platform’s highlights. These offerings and the site’s interactive nature can make the user experience feel more akin to a social media platform than a traditional brokerage service. In addition to these areas, another unique aspect of the platform is embedded ESG ratings that score assets based on socially conscious factors. You can also filter for ESG scoring in the trade search menu.

Custom watchlists can be synced between the mobile and web platforms, allowing users to keep track of their interests regardless of which version is used to access eToro. Watch lists can be customized to add volatility alerts that send notifications directly to your phone.

Mobile Trade Experience

eToro’s mobile app is user-friendly and created with a simple, uncluttered design. The straightforward design combined with the feel of a social media app makes for an innovative, creative user experience. The app has interactive functionality to engage with other traders and navigate to popular investor profiles.

Beginner investors may feel more comfortable with the app’s familiarity since eToro is not modeled like other traditional brokerage offerings. Experienced traders looking to execute orders without the social feel may find eToro to be a bit of an adjustment, but overall, the mobile app is very intuitive.

Range of Offerings

eToro provides a much wider range of offerings on international versions of the experience, but the U.S. platform has very limited offerings compared to competitors. There are no mutual funds, futures contracts, or forex on eToro, and all trading is limited to long positions only—there is no short selling. On eToro, you have access to:

- 3,000 stocks

- over 300 ETFs

- 25 cryptocurrencies

- Options trading

- Cash management through eToro Money

- Portfolio automation through Smart Portfolios

- Fractional share investing

According to Investopedia’s latest Sentiment Survey, many respondents are increasing their stock market exposure to levels greater than last November despite lingering concerns about bubbles and political unrest.

Order Types

eToro offers a narrow range of order types on the platform. Basic order types include market, limit, trailing stop loss, and other similar options. Support for more sophisticated order types, like order-triggers-other (OTO), is important because these help traders navigate risk, quickly enter and exit positions, and take gains off the table.

Trading Technology

eToro doesn’t disclose order execution quality statistics. Still, it has the best execution policy and a very low payment level for order flow, suggesting that the broker follows it. One of the most helpful features of the platform is a free demo account, which is included for all eToro members so they can practice trading before entering the market. Users start with $100,000 in virtual currency.

eToro’s Smart Portfolios lets you select from diversified automated portfolios, so you don’t have to allocate your money. You can invest in various portfolios focusing on everything from private equity and infrastructure to technology and health care while blending the allocation of ETFs, stocks, and cryptocurrency. An investment team monitors the portfolio offerings to ensure that they continue to match thematic elements and risk parameters. These portfolios are particularly appealing to beginner investors.

The trading technology associated with ETF and stock trading is relatively straightforward. Charting capability is included with all asset types, but no backtesting capabilities are included on the platform. Users can create and customize a trading journal. Beyond that, screening tools and other more robust trading functionality are largely absent.

The CopyTrader product and social trading element remain the focus of eToro’s trading experience.

Costs

eToro’s fees are in line with most other crypto and trading platforms.

- There are no fees or commissions for ETFs and stocks (ETFs may have internal costs).

- Crypto trading incurs a 1% fee for the amount of crypto bought or sold.

- There is a $5 withdrawal fee and a $30 withdrawal minimum.

- Transfer fees are incurred when you transfer crypto off of the eToro platform and into the eToro Money crypto wallet.

- A $10 monthly inactivity fee is applied for inactive users for over a year.

- A $75 transfer fee applies when transferring accounts elsewhere.

What Do Brokers Charge To Trade?

| Fee | Minimum | Average | Maximum |

|---|---|---|---|

| ETF Trade Fee($) | $0.6$0.6$0.6 | $1.5$1.5$1.5 | $2.3$2.3$2.3 |

| Minimum Deposit($) | $0.0$0.0$0.0 | $2.5$2.5$2.5 | $7.0$7.0$7.0 |

| Mutual Fund Trade Fee($) | $0.0$0.0$0.0 | $24.9$24.9$24.9 | $35.0$35.0$35.0 |

| Options Base Fee($) | $0.0$0.0$0.0 | $39.2$39.2$39.2 | $75.0$75.0$75.0 |

| Stock Trades($) | $0.0$0.0$0.0 | $0.6$0.6$0.6 | $1.0$1.0$1.0 |

How This Broker Makes Money From You and for You

eToro makes money by taking the difference between bid and ask prices. Brokers typically price trades and collect fees, even if a platform notes fee-free or commission-free trading.

- Interest on uninvested cash: On Nov. 29, 2023, eToro announced the launch of an interest-on-cash feature. Available to eToro Options account holders, the new opt-in program offers 4.9% APR on cash balances and is free for eligible users with an at-rest cash balance of $5,000 or more. Users who opt into the program and maintain less than $5,000 at rest in their account will still benefit from the offering but will be charged a small monthly fee.

- Payment for order flow: Many brokers generate income by accepting payment from market makers to direct orders to those trading venues. This is called payment for order flow (PFOF). eToro’s PFOF agreement is with a clearing firm called Apex, although a February 2022 F-4 filing with the SEC states that eToro does not practice PFOF. The simple translation of the filing is that Apex may collect PFOF and share a portion with eToro, but the broker is focused on execution quality and not PFOF.

- Stock loan programs: No stock loan programs are offered.

- Price improvement: No price improvement information is available. eToro has a best execution policy, but the policy does not include execution statistics.

- Portfolio margin: No portfolio margin accounts are offered.

- Cryptocurrency: eToro charges a 1% fee for the amount of crypto assets bought or sold.

Account and Research Amenities

Traders can search for stocks and ETFs on the discovery page, search bar, and home screen. For crypto assets, traders can browse from a menu of available coins or view portfolios of other investors and decide whether to use the CopyTrader feature to copy popular traders automatically.

eToro lacks many tools, calculators, and detailed trading functionality that most sophisticated investors would find necessary to execute advanced trading techniques. Planning and screening tools are also largely non-existent.

However, as you level up, the eToro Club offers five separate site tiers that progressively unlock more research features and news options. The tiers range from Silver, Gold, Platinum, and Platinum+ to Diamond, requiring deposits ranging from $5,000 to $250,000.

Stock Screener

eToro doesn’t have a traditional, detailed stock screener that allows you to filter by price-to-earnings, market cap, etc. It lists the biggest daily movers that can be further filtered by industry or exchange. Filtering the list will also display users’ sentiment on the platform, with a percentage of people buying listed. You can also add the biggest movers to a watchlist.

ETF and Mutual Fund Screener

No ETF screener tools are available, and the platform offers mutual funds.

Options Screener

eToro now offers an options screener after the recent addition of its options trading platform.

Fixed Income Screener

No fixed-income assets are available on eToro.

Tools and Calculators

eToro has no tools or calculators of note. Goal and financial planning tools are not offered.

Charting

eToro provides charting capabilities through a professional-grade technical tool, ProCharts. This charting feature helps you analyze an asset’s history and performance by providing line, bar, and candle charts. ProCharts also lets you view two or more charts on the same screen, enabling you to compare their performance.

ProChart users can filter their data by time interval or price. Some more sophisticated tools, including Fibonacci retracement and accumulative swing index, are also available from the chart screen. Users can place trades directly from the desktop chart. One major drawback, however, is that eToro’s charting platform does not provide volume analysis, which is a major component of technical market analysis.

Trading Idea Generators

CopyTrader provides the extent of trading idea generators at eToro. Users can search for, follow, and copy trades of investors that match their interests and goals. This feature is only available for crypto.

News

A news and analysis tab offers a variety of weekly site journals and insights that provide content appealing to different interests, including the Crypto Roundup and The Bottom Line. The eToro Club unlocks more news and research features with more money invested in the platform.

Silver-level members get access to live-stream webinars, while Gold and Platinum members add a subscription to Delta PRO and Business Insider. Platinum+ members and Diamond users unlock Wall Street Journal and Financial Times subscriptions.

Third-Party Research

eToro’s third-party research is powered by TipRanks, a leading source for up-to-date recommendations from professional analysts at investment banks and financial companies worldwide.

Cash Management

eToro Money is the platform’s solution to cash management needs. With this feature, you can deposit and withdraw funds, easily send and receive money, and store crypto.

Fractional Dividend Reinvestment Plan (DRIP)

Although eToro has fractional investing, dividends paid out on the platform are not automatically reinvested in your portfolio. eToro credits payment to your cash balance if you hold a position in a stock or ETF that pays dividends.

SRI/ESG Research Amenities

Environmental, social, and governance (ESG) scores are provided for more than 2,000 assets on the platform. eToro makes this information especially visible, as you’ll see different color patterns and a rating based on how well an asset aligns with socially conscious values. When searching for assets, you can also screen for socially responsible investing (SRI) and ESG factors with a filter.

Portfolio Analysis

eToro provides limited portfolio analysis, especially compared to competitor platforms. While you can see current balances and positions clearly, not much exists in the way of further analysis outside of charting features. eToro’s charting capabilities are adequate, but they give you a better sense of performance rather than helping you see where portfolio changes might be needed.

Investopedia’s latest Sentiment Survey has uncovered that “While ETFs and stocks remain our readers’ top choices for what they are currently doing with their money, the perceived frothiness of some sectors and the overall market would not necessarily deter them from buying more—especially if they had an extra $10,000 to spare.”

Education

The eToro Academy is an online educational portal accessible to everyone. While many articles educate on cryptocurrency, other materials focus on products like the Smart Portfolio and trading strategies like technical indicators.

A filter lets you quickly toggle the educational library between beginner and advanced material, allowing you to customize the experience to your skill level. Various educational formats, including long-form articles and videos, are also available.

With the introduction of stock and ETF trading in 2022, the education material still has a lot of room to grow so that the platform provides more comprehensive, insightful content.

Customer Service

eToro provides a help center with a large volume of FAQ articles addressing a range of potential inquiries. Outside of this self-serve option, more traditional customer support options are limited. Phone and email support is available, but the contact information is not readily available for you to find. Chat functionality is provided through the help center to chat directly with an agent. You can also open a support ticket online.

Security and Reliability

- Two-factor authentication (2FA) and biometric fingerprint entry

- Equity assets like stocks and ETFs are covered by the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

In addition to the above SIPC insurance, eToro’s clearing partner, Apex, also added supplemental insurance, protecting eToro customers with up to $37.5 million in securities and $900,000 in cash per individual.

EToro provides a digital wallet to store cryptocurrency, the eToro wallet. Users can transfer cryptocurrency from eToro’s platform to their digital wallet. Still, they should note that coin transfers are one-way, meaning any coins transferred can’t be transferred back to the eToro trading platform.

Transparency

eToro generally has a transparent platform in terms of pricing but lacks execution statistics. Crypto pricing is explicitly laid out at 1% of all trades. There are no stock and ETF trading fees, although some ETFs may carry additional expenses independently. The spread pricing and payment for order flow (PFOF) information are also available. Users’ inability to transfer coins from their wallets back to the eToro trading platform may not be immediately obvious to clients.

Available Account Types

Individual brokerage and options accounts are the only accounts that can be opened with eToro. Joint, retirement, trust, and custodial accounts are unavailable. Just as notable, eToro doesn’t support margin accounts. This aspect can be a severely limiting factor for users looking to open accounts that are better suited for various goals.

Final Verdict

The social trading experience is the standout feature of eToro’s trading experience. The CopyTrader dynamic, paired with the Popular Investor Program, gives the platform an engaging, collaborative feel. The introduction of stock and ETF trading combined with eToro Money cash management and Smart Portfolios further expands the range of users who can utilize the platform’s services. Innovative approaches to ESG screens and filters also attract investors who prioritize these aspects.

However, the platform’s severe limitations will give many traders pause before seriously considering eToro as their preferred trading platform. The lack of powerful financial calculators, research tools, and trading amenities largely prevents many investing strategies from being executed. The significant restrictions in the available stock and ETF selections combined with the lack of margin account or options trading support eliminate many potential traders.

Even though it has recently added options to its product offerings, until eToro moves to add more robust platform features and trade functionality, the experience is best suited for individuals who prioritize the social investing dynamic as their main trading interest.

Compare to Similar Brokers

| Criteria | Webull | Robinhood | Public | eToro |

|---|---|---|---|---|

| Overall Star Rating | 3.0 | 2.7 | 2.0 | 3.4 |

| Minimum Deposit | $0.00 | $0.00 | $0.00 | $10.00 |

| Stock Trade Fee (per trade) | $0.00 | $0.00 | $0.00 | $0.00 |

| Options Trade Fee (per contract) | $0.00 | $0.00 | N/A | $0.00 |

| Tradable Assets | Stocks, ETFs, Cryptocurrency | Stocks, ETFs, Options | Stocks, ETF | Stocks, ETFs, Futures, Options |

| Fractional Shares | Yes | Yes | Yes | Yes |

| # of No-Load Mutual Funds | N/A | N/A | N/A | N/A |

| # of Options Max Legs | 4 | 4 | N/A | 2 |

| Key Portfolio Tracking Features | N/A | A sector allocation monitor | N/A | N/A |

| Available Screeners | Stocks, Options | N/A | Stocks, ETFs, Cryptocurrency | ESG/SRI, Stocks, ETFs, Crypto asset |

| # of International Exchanges | N/A | N/A | N/A | 19 |

| Customer Support Methods | Email, Live Chat, Phone, FAQ, Live Broker | Email, FAQ, Phone (no incoming calls, app-based return call system only) | Email, Live Chat, FAQ | Email, FAQ |

| Available Education | Articles, Videos | Stocks, ETFs, Cryptocurrency | Articles | Articles, Videos, Webinars, Live events/seminars. |

| Proprietary Research | Yes, with no additional cost | No | Yes, with no additional cost | Yes, with no additional cost |

| 3rd Party Research | Yes, with additional cost | Yes, with additional cost | No | Yes, with no additional cost |

Is eToro a Good Broker for Beginners?

eToro is user-friendly and provides access to enough assets to satisfy most investors just starting. Where eToro loses some ground for beginners is in the educational support around investing. However, it gets points for the free demo account that users can use to learn before making money. If you are comfortable with investing concepts and want to learn hands-on, then eToro can fill that niche. We’d like to see more analysis tools and onboarding content, but the social element may take care of that for crypto-focused investors.

Trade on the Go. Anywhere, Anytime

One of the world’s largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You’ll also have access to Binance tools that make it easier to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

Methodology

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This year, we revamped the review process by conducting an extensive survey of customers looking to start trading and investing with an online broker. We then combined this invaluable information with our subject matter expertise to develop a quantitative rating model framework at the core of how we compiled our list of the best online broker and trading platform companies.

This model weighs key factors like trading technology, range of offerings, mobile app usability, research amenities, educational content, portfolio analysis features, customer support, costs, account amenities, and overall trading experience according to their importance. Our team of researchers gathered 2425 data points and weighted 66 criteria based on data collected during extensive research for each of the 25 companies we reviewed.

Many of the brokers we reviewed also gave us live demonstrations of their platforms and services, either at their New York City offices or via videoconferencing. For most of the platforms we reviewed, our expert writers and editors obtained live brokerage accounts, which they used to perform hands-on testing and lend their qualitative points of view.