Table of Contents

The most successful investors were not made in a day. Learning the ins and outs of the financial world and your personality as an investor takes time and patience, not to mention trial and error. In this article, we’ll lead you through the first seven steps of your expedition into investing and show you what to look for.

KEY TAKEAWAYS

- Your investing journey starts with a plan and a time frame. When you know how long you’re investing for and what you hope to gain, you can put the structure in place to achieve your goals.

- Next, learn how the market works, what investment strategy is best for you, and what kind of investor you are.

- Be careful who you’re taking advice from, and be mindful of your prejudices and assumptions as you find the right path.

- Ensure you understand this is a long-term journey so you won’t get tripped up by short-term setbacks; always stay open and learn from your mistakes.

1. Getting Started in Investing

Successful investing is a journey, not a one-time event, and you’ll need to prepare yourself as if you were going on a long trip. Begin by defining your destination, then plan your investment journey accordingly. For example, are you looking to retire in 20 years at age 55? How much money will you need to do this? You must first ask these questions. The plan that you come up with will depend on your investment goals.

2. Know What Works in the Market

Read books or take an investment course that deals with modern financial ideas. The people who came up with theories such as portfolio optimization, diversification, and market efficiency received their Nobel prizes for good reason. Investing combines science (financial fundamentals) and art (qualitative factors).

The scientific aspect of finance is a solid place to start and should not be ignored. If science is not your strong suit, don’t fret. Many texts, such as Stocks for the long run by Jeremy Siegel, explain high-level finance ideas in a way that is easy to understand.

Jeremy J. Siegel. “Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies.” McGraw-Hill Education, 2014.

Once you know what works in the market, you can devise simple rules that work for you. For example, Warren Buffett is one of the most successful investors ever. This well-known quote sums up his simple investment style: “Never invest in a business you cannot understand.” It has served him well. While he missed the tech upturn, he avoided the subsequent devastating downturn of the high-tech bubble of 2000.

Best Brokers for Day Trading

See Which online brokers provide speed and reliability at a low cost. We’ve broken down the pros and cons of each to help you make the best decision for your day trading needs.

LEARN MORE >

3. Know Your Investment Strategy

Nobody knows you and your situation better than you do. Therefore, you may be the most qualified person to do your investing—all you need is a bit of help. Identify the personality traits that will assist you or prevent you from investing successfully and manage them accordingly.

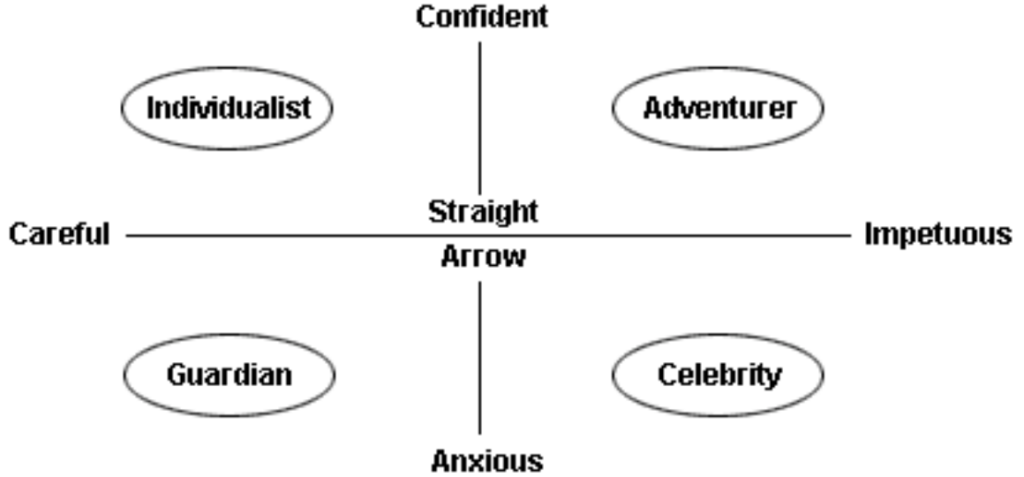

Fund managers Tom Bailard, Larry Biehl, and Ron Kaiser developed a useful behavioral model that helps investors understand themselves.

The model classifies investors according to two personality characteristics: method of action (careful or reckless) and confidence level (confident or anxious).

Based on these personality traits, the BB&K model divides investors into five groups:

- Individualist – careful and confident, often takes a do-it-yourself approach

- Adventurer – volatile, entrepreneurial, and strong-willed

- Celebrity – a follower of the latest investment fads

- Guardian – highly risk-averse, wealth preserver

- Straight Arrow – shares the characteristics of all of the above equally

The best investment results are realized by an individualist or someone who exhibits analytical behavior and confidence and has a good eye for value. However, if you determine that your personality traits resemble those of an adventurer, you can still achieve investment success if you adjust your strategy accordingly.

In other words, regardless of which group you fit into, you should manage your core assets in a systematic and disciplined way.

4. Know Your Friends and Enemies

Beware of false friends who only pretend to be on your side, such as certain unscrupulous investment professionals whose interests may conflict with yours. You must also remember that, as an investor, you are competing with large financial institutions with more resources, including greater and faster access to information.

Bear in mind that you are potentially your own worst enemy. Depending on your personality, strategy, and particular circumstances, you may be sabotaging your success. A guardian would be going against their personality type if they followed the latest market craze and sought short-term profits.

Because you are risk-averse and a wealth preserver, you would be affected far more by large losses resulting from high-risk, high-return investments. Be honest with yourself, and identify and modify the factors preventing you from investing successfully or moving you away from your comfort zone.

5. Find the Right Investing Path

Your level of knowledge, personality, and resources should determine the path you choose. Generally, investors adopt one of the following strategies:

- Don’t put all of your eggs in one basket. In other words, diversify.

- Put all your eggs in one basket, but watch your basket carefully.

- Combine these strategies by making tactical bets on a core passive portfolio.

Most successful investors start with low-risk diversified portfolios and gradually learn by doing. As investors gain greater knowledge over time, they become better suited to taking a more active stance in their portfolios.

Important: Online brokers offer many tools to help investors of all levels; we’ve reviewed and ranked more than 70 online brokers to find the best one.

6. Be in It for the Long Term

Sticking with the optimal long-term strategy may not be the most exciting investing choice. However, your chances of success should increase if you stay the course without letting your emotions or “false friends” get the upper hand.

7. Be Willing to Learn

The market is hard to predict, but one thing is certain: it will be volatile. Learning to be a successful investor is a gradual process, and the investment journey is typically long. At times, the market will prove you wrong. Acknowledge that and learn from your mistakes.

Whether you are just getting started or want to improve your skills, check out the Investopedia Academy, which has dozens of online courses for every kind of investor.

FAQs

1. How Should a Beginner Start to Invest?

Ans: The first step a new investor should take is determining their investment goals. “Why are you investing?” Are you planning for retirement? Saving up to buy a house? Knowing your goals will guide your investment decisions. From there, determine your investment vehicles, such as purchasing stocks, investing in ETFs or mutual funds, setting up a retirement account, etc. You should also consider how much you want to invest and your time horizon.

2. What Are Good Beginner Investments?

Ans: One of the best ways to start investing is by contributing to your retirement account at work if you have one. For example, if your company has a 401(k), you can start contributing there. If it does not, you can start retirement planning with an IRA. From there, a simple way to invest is by putting money in an index fund, which tracks an index such as the S&P 500. These funds, particularly exchange-traded funds (ETFs), are easy to buy and sell, have low fees, and provide wide market exposure.

3. How Much Money Do I Need to Start Investing?

Ans: You can start investing with any amount of money. If you have a retirement plan at work, you can allocate part of your salary to contribute to the plan. If there is a stock you want to buy, you only need enough to buy one share to get started.

The Bottom Line

Starting to invest can be an exciting time but also challenging for newcomers. There are many financial products and different investment advice out there. As you start, educate yourself on investing, lay out your financial goals, and don’t rush to make a fortune. Taking the time to learn about investing and carefully making the right choices for you should allow you to generate a tidy return.

Trade on the Go. Anywhere, Anytime

One of the world’s largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You’ll also have access to Binance tools that make it easier to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.