Table of Contents

New York City is not only the financial capital of America but also of the world. While the city’s financial dealings grew out of Wall Street, at the southern tip of Manhattan, large financial institutions and companies are now spread out throughout the city. Though New York’s power in American finance is undisputed, it was not always this way.

The first bank and stock exchange in the U.S. were established in Philadelphia, PA, and for a time, that city, not New York, stood as the pillar of the American financial world.

Despite Philadelphia’s first-mover advantage, several geographic, economic, and political factors helped The Big Apple overtake the city of brotherly love to become the nation’s leading financial center.

KEY TAKEAWAYS

- New York City became the financial epicenter of the world despite Philadelphia having a first-mover advantage.

- New York gained ground on Philadelphia thanks to its dominance in commercial trade, largely thanks to the completion of the Erie Canal in 1825.

- New York became the leader in American finance after the Second Bank of the United States failed to renew its charter in 1836.

The Philadelphia Story

One of the first signs of Philadelphia’s financial supremacy was the establishment of the Bank of Pennsylvania in 1780 and its role in helping to finance the Revolutionary War.

As the nation’s largest city and acting capital during the last decade of the 18th century, it would become the location for the nation’s first federally chartered bank—the First Bank of the United States. Acting as a de facto central bank, it established Philadelphia as the initial center of American finance.

The failure of the First Bank to renew its charter in 1811 for political reasons did not disrupt this supremacy, as financial instability following the War of 1812 would help to bring about the chartering of the Second Bank of the United States in 1816, also located in Philadelphia.

As the nation’s only federally chartered bank—and given the special privileges that came with it—the bank exerted its power and influence over the rest of the nation’s state-chartered banks, which was notable in the history of U.S. banking regulation.

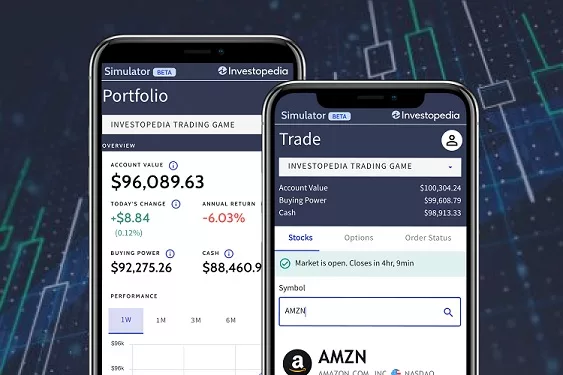

Investopedia Essentials

Try the Investopedia stick Simulator.

Are you new to investing? Learn how to trade in real-time on our virtual stock simulator. Our platform helps teach you the right strategies for building and maintaining wealth.

Philadelphia’s stock exchange further illustrated its place as the leading financial center. Indeed, the Philadelphia Stock Exchange, established in 1790, is older than the New York Stock Exchange (NYSE), and even as late as 1815, London banks looked to Philadelphia rather than New York to buy American securities.

Turning Points

Realizing the dominance of Philadelphia’s security exchange market, New York formalized its exchange by establishing the New York Stock and Exchange Board in 1817, which later became the NYSE. New York looked to lure investors away from Philadelphia with a new exchange and home to more banks than its southern competitor.

By this time, New York had already surpassed Philadelphia as the nation’s leader in commercial trade. It was a top coastal trade city by 1789, overtaking Philadelphia in the value of imports in 1796 and the value of exports in the following year. While New York’s superiority in commercial trade was evident by 1815, it wasn’t until the Erie Canal was completed in 1825 that New York’s ascendancy became clear.

Geographical Advantage

New York’s supremacy in trade has a lot to do with geographical factors, but many more contingent developments also helped it. Not only was New York a central location for inbound European merchants, but its ports proved to be much more convenient than either Philadelphia’s or Boston’s. Being deeper, the Hudson River proved to be much more navigable and less prone to freezing over than both the Delaware River and the Charles River.

New York’s geographical advantage was supplemented by constructing the Erie Canal (1817–1825) and establishing Black Ball Lines in 1818. While the Erie Canal connected the Hudson River to the Great Lakes and consequently to the fastest-growing parts of America west of the Appalachian Mountains, the Black Ball Line provided the first-ever regularly scheduled transatlantic passenger service.

Both the Canal and the Line helped to solidify New York’s place as America’s center of commercial trade and central transportation hub.

As the first port of entry for many immigrants, New York became a convenient place to settle, helping stimulate an unstoppable rise in the city’s population that would grow to be 10% larger than Philadelphia’s by 1820 and as much as twice as large by 1860. The flow of immigrants also helped to increase manufacturing and commercial activity even further.

FAST FACT

JPMorgan Chase, headquartered in New York City, is the largest bank in the U.S. by total assets.

The Adventurous Spirit

These new immigrants also brought a more adventurous, risk-taking spirit that contrasted with the more cautious nature of Philadelphia’s Quaker heritage. As a result, New York quickly developed a reputation for being a city of innovative business enterprise, with an entrepreneurial ethos that lent itself to speculative investment behavior.

Speculation further enhanced the voluminous trade in New York’s securities markets by keeping them awash with liquidity.

A market for call loans developed in New York to finance increasing stock trading. Using securities as collateral, stock traders could borrow money from the banks to make further speculative investments. This behavior proved mutually beneficial for New York’s banks and its stock market, as the banks earned interest on the loans while the borrowed money allowed further securities trading.

New York Gains the Upper Hand

By the 1830s, having become the nation’s dominant commercial center, Wall Street kept the major deposit balances of all of America’s banks. The only thing keeping New York from claiming the title of the nation’s leading financial center was the existence of the Philadelphia-located Second Bank of the United States, whose charter was set to expire in 1836.

It had become extremely irritating to Wall Street bankers because New York was the main source of Federal Customs receipts, but rather than being deposited in New York banks, they were deposited at the Second Bank.

While then-President Andrew Jackson had reasons for antagonizing the Second Bank, the Wall Street bankers’ interests were given a voice through Martin Van Buren, an influential New Yorker who became Jackson’s advisor.

Regardless of the precise motives, the Second Bank of the United States failed to renew its charter in 1836, essentially determining New York’s fate as the center of American finance. This fate would be further strengthened by the National Banking Acts of 1863 and 1864, which would put New York at the top of a hierarchical banking structure.

The 1864 version of the act stipulated that all national banks must maintain 15% reserves of lawful money in New York.

FAQs

1. Why Is New York the Economic Capital of the World?

Ans: New York is the world’s economic capital because many of the largest companies in the world, specifically financial institutions, are headquartered there. It also has the world’s largest and second-largest stock markets, which are the center of global financial markets and include some of the largest corporations in the world.

2. What Is the Financial Capital of Europe?

Ans: London is the financial capital of Europe. It contains large stock markets, banks, and other financial institutions. Much of the financial business in Europe is done in or through London. Even after Brexit, London remains the foremost financial center in Europe.

3. What Is the Largest Stock Market in the World?

Ans: The New York Stock Exchange is the world’s largest stock market by market capitalization. As of 2023, it had a market cap of $25.24 trillion.

The Bottom Line

Despite being home to the nation’s first bank and stock exchange, Philadelphia’s initial advantages would not be enough to maintain its financial dominance over New York City’s growing influence. By utilizing its unique geographical features, New York overtook Philadelphia as the nation’s transportation and immigration hub.

From there, New York quickly surpassed its southern competitor in commercial trade and finally gained American financial supremacy—a role it maintains today.

Trade on the Go. Anywhere, Anytime

One of the world’s largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You’ll also have access to Binance tools that make it easier to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.