Table of Contents

A comprehensive wealth management platform with affordable fees and low minimum account requirements compared to similar platforms.

We research and independently suggest the best products and services. Learn more about our review process and partners in our advertiser disclosure. We may earn commissions on purchases made through our recommended links.

J.P Morgan

:max_bytes(150000):strip_icc():format(webp)/JP-Morgan-Wealth-Management-logo-ade8233c1902404a940f2f569dbf09eb.jpg)

OVERALL RATING

OVERALL RATING

OVERALL RATINGFAST FACTS

Account Minimum: $25,000

Fees: 0.40% to 0.60% based on portfolio size, plus investment fund expenses.

The bank does not guarantee investment and insurance products, which the FDIC does not insure, are not deposits, and may lose value.

Our Take

J.P. Morgan Personal Advisors is a service that offers a team of financial advisors to help manage your investments. It combines an investment platform that oversees your investments with guidance from licensed fiduciary financial advisors who actively plan and manage your portfolio.

The service charges reasonable fees, especially when compared to hiring your investment advisor. While you need a minimum of at least $25,000 to use this service, it’s lower than other top financial planning services. If you’re considering this wealth management platform with the support of fiduciary advisors committed to your account, our J.P. Morgan Personal Advisor review can help you decide.

Pros & Cons

Pros

- Get free access to human financial advisors, which is included.

- Affordable charges

- Great selection of investment options and strategies

- Offers portfolios focused on environmental, social, and governance (ESG) criteria

Cons

- An advisor needs to design a portfolio that matches your financial requirements.

- Your advisor has to arrange any changes to your portfolio.

- There’s no automatic tax-loss harvesting feature.

Account Overview

| Account Minimum | $25,000 |

| Fees | Fees range from 0.40% to 0.60%, depending on the size of your portfolio, in addition to investment fund expenses. |

| Goal Planning | Goals encompass retirement, retirement healthcare, home purchasing, education, major acquisitions, and personalized objectives. |

| Available Assets | ETFs and mutual funds are investment options. |

| Interest Paid on Cash Balances | 0.01% |

| Customizable Portfolio | Yes, changes are made by asking a human advisor. |

| View Portfolio Before Funding | Yes, but you must schedule a phone or video meeting with an advisor first. |

| Customer Service | Help Center FAQ, email, and phone support are available from advisors. |

| Financial Advisor Available | Yes |

| Cash Management | Yes, checking and savings accounts are available. |

| Mobile App | Android, iOS |

Account Setup

To start with J.P. Morgan Personal Advisors, you must schedule a phone or video meeting with one of their advisors. You can call J.P. Morgan at 833-930-4515 from Monday to Friday, 8 a.m. to 9 p.m. ET. You can also fill out a form with your contact information, and an advisor will reach out to arrange the meeting.

During this meeting, the advisor will ask about your goals and priorities. They’ll use this information to make a financial plan and suggest investment options. This process may take two or three meetings.

You can fund your account if you are satisfied with the plan and investments. You’ll need at least $25,000 to use J.P. Morgan Personal Advisors. You can transfer cash, existing investments, or a retirement plan.

Unfortunately, you cannot test the J.P. Morgan Personal Advisors platform without speaking to an advisor first. You have to go through the formal enrollment process to get access. This is a downside of using J.P. Morgan Personal Advisors.

Goal Planning

In your first meeting with a J.P. Morgan advisor, they’ll talk to you about your investment goals, whether big or small. This could be retirement savings, setting aside money for a big purchase, or getting ready to start a business. The advisor will use this info to make investment plans that match your desires. If your goals change later, you can meet with the advisor again to change your plan. They’ll update your investments as needed to fit your new goals.

As a client of J.P. Morgan Personal Advisors, you’ll also get access to retirement planning tools and support from the advisors.

- Retirement Analysis: The advisors assess your situation by checking your savings, planned retirement spending, and other income.

- Financial Plan Recommendations: The advisors suggest ways to help you save more money. They also think about other investment options, such as whether you should buy an annuity.

- Social Security Analysis: The advisors help you determine the right age and tactics for starting Social Security. They consider your income, age, and marital status to find the best approach.

- Tax Planning: The advisors suggest ways to handle taking money out of your various retirement accounts to reduce taxes.

J.P. Morgan Personal Advisors is great for setting goals because you can create a personalized financial plan with a real advisor. You’re not stuck with pre-made choices from a computer program.

Account Services

You can use its cash management and investment services once you start your J.P. Morgan Personal Advisors account. These services blend automated planning with help from your human financial advisor.

Cash Management

J.P. Morgan Personal Advisors offers automatic sweeps for your extra cash. They move your uninvested cash into a daily money market fund to earn a small interest of 0.01%. You work with your financial advisor to set up this feature and decide how often it checks your account: daily, weekly, or monthly. You need at least $2,500 in uninvested cash to qualify for this automatic sweep into the money market fund.

You can sign up separately if you’re a J.P. Morgan Personal Advisors customer and want a checking or savings account. You can transfer money between your investment account and these bank accounts if you already have them. The checking account allows free ATM withdrawals and provides support at all Chase branches, along with concierge services.

Additionally, J.P. Morgan Personal Advisors offers customers the option to sign up for checking or savings accounts separately. You can easily transfer money between your investment and bank accounts if you already have these accounts. The checking account permits free withdrawals from any ATM and provides access to support services at all Chase branches, along with concierge services for added convenience.

Portfolio Construction

During your first meeting with J.P. Morgan Personal Advisors, the advisor will talk to you about your goals, how much risk you’re comfortable with, how long you plan to invest, and how much money you already have saved. They’ll use this information to create a portfolio of investment funds that fits your goals. They’ll also decide on the best mix of investments for you.

J.P. Morgan Personal Advisors picks investments for your portfolio from Fidelity, PIMCO, Schwab, and Vanguard. Some portfolios stick to safer strategies that follow the market, while others take more risks to do better than the market. Advisors can also choose funds that focus on specific goals or strategies.

Target date: You choose a year to use the money, and the advisor sets up a mix of investments that fits this timeline. As the target date gets nearer, the advisor checks to see if it makes sense to change to safer investments based on how much risk you’re okay with and how long you have left to invest.

Age-based: During regular meetings with the advisor, clients can adjust their investment mix as they age.

Income: This approach aims to make money while keeping your initial investment safe instead of just trying to grow your portfolio. J.P. Morgan offers funds that follow environmental, social, and governance (ESG) criteria. You can ask for funds like the ESG Leaders Fund, which invests in companies with high ESG scores, or the low-carbon fund, which focuses on companies with a small carbon footprint.

- Environmental, social, and governance (ESG) criteria: You can ask for J.P. Morgan funds focusing on ESG goals. These funds include choices like the ESG Leaders Fund, which invests in companies with strong ESG scores, or the low-carbon fund, which targets companies with minimal carbon footprints.

J.P. Morgan Personal Advisors only allows investment funds in your portfolio. You can’t include individual stocks or bonds.

| Available Assets | |

|---|---|

| Individual Stocks | No |

| Mutual Funds | Yes |

| Fixed Income | Yes (only through ETFs) |

| REITs | No |

| Socially Responsible or ESG Options | Yes |

| ETFs | Yes |

| Non-Proprietary ETFs | Yes |

| Private Equity | No |

| Crypto | No |

| Forex | No |

Portfolio Customization

J.P. Morgan Personal Advisors lets you customize your investment portfolio with the help of a licensed advisor. They’ll create a portfolio based on your goals, how much risk you’re comfortable with, and what’s important to you. With access to 21 investment models, the advisor can tailor your portfolio to fit any timeline or preference.

Unlike fully automated robo-advisors, J.P. Morgan Personal Advisors allows human advisors to customize your portfolio to meet your needs.

However, a downside is that you must ask your advisor to make any changes to your investments or portfolio. You can’t log in and adjust them yourself, which might be frustrating if you prefer managing your investments independently.

Portfolio Management

Once you and your advisor create your portfolio, a team of fiduciary advisors will manage it. The platform gives you daily updates on your investments and whether you’re reaching your goals. It also compares your portfolio’s performance to similar ones.

If your portfolio drifts too far from your target, it will be automatically adjusted to stay on track. Your advisor will check your portfolio regularly and make necessary changes to keep you on course.

J.P. Morgan Personal Advisors doesn’t have automated tax-loss harvesting, but you can ask for it. This feature looks for opportunities to sell investments to lower taxes and replace them. You can also link external investment accounts to the platform, and your advisor will consider them when setting your goals.

If you want to change your portfolio, schedule a meeting with your advisor to discuss your new goals. They’ll update your portfolio accordingly. Your advisor will monitor your portfolio and make adjustments to help you meet your goals.

| Key Portfolio Management Features | |

|---|---|

| Automatic Rebalancing | Portfolio adjustments occur regularly, at least once every three months, to address any drift as necessary. |

| Reporting Features | Instant updates on how your portfolio is doing compared to the benchmark and its asset allocation. |

| Tax-Loss Harvesting | Human advisors report portfolio performance compared to benchmark and asset allocation in real-time. |

| External Account Syncing/Consolidation | Human advisors provide portfolio recommendations and suggestions for tax-loss harvesting. |

User Experience

Desktop

The J.P. Morgan Personal Advisors website is simple to use. It shows your portfolio breakdown and provides basic details about your investment plan, like your goals and how long you plan to invest. You also get retirement and goal-planning tools useful for investors who like to manage things independently.

Mobile

J.P. Morgan provides a mobile app for tracking your accounts, setting goals, and arranging meetings with a financial advisor. The app has a clean and easy-to-use design. This simplicity has helped J.P. Morgan Wealth Management win customer satisfaction awards with its desktop platform and mobile app.

Customer Service

When you become a J.P. Morgan Personal Advisors client, you’re matched with a team of financial advisors. These advisors will be your main contacts for any questions or help with your account. While you might talk to different advisors, they’ll all be part of your assigned team. You can also send secure messages to your team through the online portal or mobile app. And if you need to, you can schedule meetings over the phone or by video call.

You can reach J.P. Morgan Personal Advisors’ phone support line Monday to Friday, from 8 a.m. to 9 p.m. ET.

Security

J.P. Morgan uses strong security measures to keep its users safe, including:

- Website encryption keeps your information safe by turning it into a code that’s hard for others to understand.

- Two-factor authentication adds an extra layer of security when you log in by requiring two different ways to confirm your identity.

- Network firewalls act as protective barriers for computer networks, blocking unauthorized access and potential threats from reaching the system.

- Secure data centers are highly protected facilities where information is stored safely and protected from unauthorized access or damage.

- Notifications for accessing your account help you stay informed about any activity happening with your account.

J.P. Morgan Personal Advisors offers SIPC insurance for your investment account, providing coverage of up to $500,000 for your investments and up to $250,000 for uninvested cash. Additionally, if you have a Chase collection account, your deposits are protected by FDIC insurance.

Education

The platform’s main page offers a list of common questions about using J.P. Morgan Personal Advisors, helpful videos, and screenshots. You can also explore various J.P. Morgan Wealth Management educational resources, including articles, videos, and market news updates.

If you’re new to investing, J.P. Morgan provides a beginner’s guide to help you get started step-by-step. With support from financial advisors and access to educational materials, J.P. Morgan Personal Advisors offers a good range of resources for learning about investing.

Commissions and Fees

J.P. Morgan Personal Advisors charges a fee based on the amount of money they manage for you, known as the asset under management (AUM) fee. This fee ranges from 0.40% to 0.60% per year, depending on how much money you have in your portfolio. If your account is under $250,000, you’ll pay the higher 0.60% fee, which decreases to 0.40% once your assets reach $1 million. J.P. Morgan Personal Advisors offers a free six-month trial period with no fees.

In addition to the AUM fee, you’ll also need to cover the expenses for the funds in your portfolio, which can range from 0.03% to 0.25% per year, with an average cost of 0.08%.

The human advisors in this program are fiduciaries, which means they’re legally obligated to act in your best interest. They don’t earn commissions for recommending funds and must prioritize your financial well-being when designing your portfolio.

| Category | Fee |

| Management Fees for $5,000 Account | N/A, minimum portfolio $25,000 |

| Management Fees for $25,000 Account | 0.60%, $150 per year |

| Management Fees for $100,000 Account | 0.60%, $600 per year |

| Termination Fees | None |

| Expense Ratios | The average cost for funds in your portfolio is around 0.08% per year, but it can vary depending on the specific funds and investment models you choose. |

Final Verdict

J.P. Morgan Personal Advisors could be a great choice if you want the help of a human financial advisor but are concerned about the cost. Users can meet with an advisor whenever needed, and a financial professional will actively manage their investment portfolio and financial plan. Once your portfolio is set up, the platform takes care of it with automated rebalancing and daily performance updates.

However, if you prefer to manage your investments independently, all the hands-on support from J.P. Morgan Personal Advisors might not be for you. You have to meet with a J.P. Morgan advisor to start and make changes to your portfolio. You can’t even try out the platform without scheduling a call first. This differs from robo-advisor platforms, which offer more tools and a smoother user experience to help you invest without much guidance.

But J.P. Morgan Personal Advisors isn’t trying to be like those platforms. Instead, it’s a good option for getting live support from a financial advisor along with automated portfolio management.

FAQs

1. What Is J.P. Morgan Personal Advisors?

Ans: J.P. Morgan Personal Advisors is an investment platform with access to human financial advisors, all covered by the management fee. These advisors create your financial plan and investment portfolio according to your goals, timeline, and how much risk you’re comfortable with. Then, the automated feature manages the investments and adjusts the funds as needed to match your goals. You can easily track your progress and investment performance on the platform. If you have questions or want to change your portfolio, you can schedule meetings with your human advisor through the platform.

2. How Much Does J.P. Morgan Personal Advisors Charge?

Ans: J.P. Morgan Personal Advisors charges between 0.40% and 0.60% of the money they manage For you Every year. If your portfolio is less than $250,000, you’ll pay 0.60%, between $250,000 and $1 million, 0.50%, and over $1 million, 0.40%. They don’t charge commissions for selling investments, but you still need to pay for the expenses of the investments in your portfolio, just like you would if you bought them yourself.

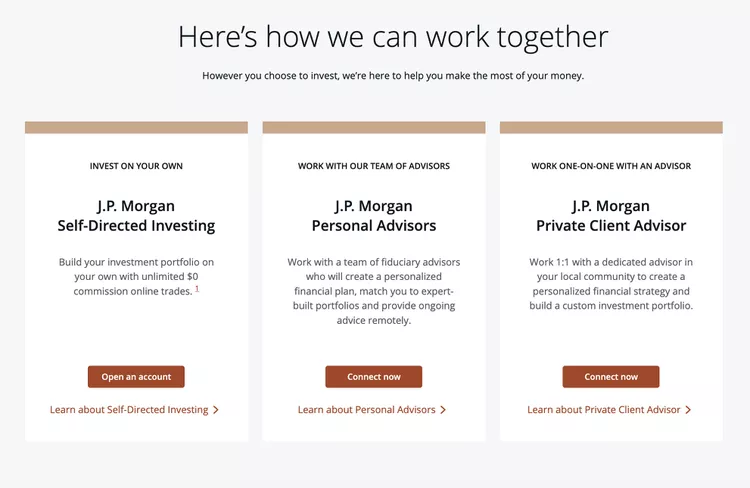

3. What Is the Difference between a J.P. Morgan Private Client Advisor and a Personal Advisor?

Ans: J.P. Morgan Personal Advisors is an online program where you communicate with an advisor over the phone, email, or video calls. On the other hand, J.P. Morgan Private Client Advisors connects you with a local financial advisor for in-person meetings. However, J.P. Morgan Private Client Advisors is more expensive, with fees reaching up to 1.45% per year, compared to the maximum fee of 0.60% for J.P. Morgan Personal Advisors.

4. What Are the Disadvantages of J.P. Morgan Personal Advisors?

Ans: J.P. Morgan Personal Advisors has a minimum investment of $25,000, which may be too high for new investors with limited funds. Additionally, you need to consult with an advisor to make updates or changes to your portfolio. You can’t adjust your investments directly through the platform, which may be inconvenient for some investors.

How We Rate Companies

For the Investopedia 2023 Best Robo-Advisors reviews, we updated our rating method to match the changing landscape of digital wealth management companies and their competitive products. We didn’t include Vanguard Personal Advisor, Empower, and J.P. Morgan Personal Advisors in our main ranking because they blend digital and human advisory services, making them different from pure digital robo-advisor platforms.

While Vanguard Personal Advisor, Empower, and J.P. Morgan Personal Advisors offer a blend of digital and human advisory services, they are among the industry’s top hybrid wealth management companies. To rate these platforms, we created a separate rating system based on categories like account services, customer service, fees, goal planning, portfolio management, security, education, and user experience, using our expertise in the field.

Trade on the Go. Anywhere, Anytime

Get ready to trade on one of the biggest crypto exchanges worldwide. Enjoy low fees and excellent customer support while trading securely. With Binance, you can easily check your trading history, manage auto-investments, view price charts, and convert currencies with no fees. Signing up is free, so join millions of traders and investors in the global crypto market today!