Table of Contents

Explore how to invest in different types of assets beyond the traditional options.

Alternatively, alternative investing could be a good option to diversify your investments and potentially earn higher returns while not closely tied to regular stocks and bonds. These investments include commodities, real estate, cryptocurrencies, art, wine, and more. Previously, only wealthy, accredited investors could access these opportunities, but now, anyone can invest through crowdfunding platforms and funds. Remember that although you might get more diversification and potentially higher returns, some investments might not be easy to sell quickly. If you’re interested in alternative investing, keep reading for a guide on how to get started.

What Is Alternative Investing?

Interest in alternative investing has surged since the 2008 recession, when traditional markets like stocks and bonds took a hit. Investors wanted options that didn’t move in the same direction as these markets. Alternative investments become more popular when regular stock and bond markets are unstable or weak.

Alternative investments cover assets that are not part of the usual stock and bond markets. In the past, only very rich people could invest in them, but now, smaller investors have opportunities, too.

Examples of alternative investment options include:

- Investing in gold and silver

- Investing in art

- Investing in wine

- Investing in real estate

- Investing in hedge funds

- Investing in private companies

- Investing in digital currency

- Investing in loans that are not publicly traded and loans of companies that are in financial trouble.

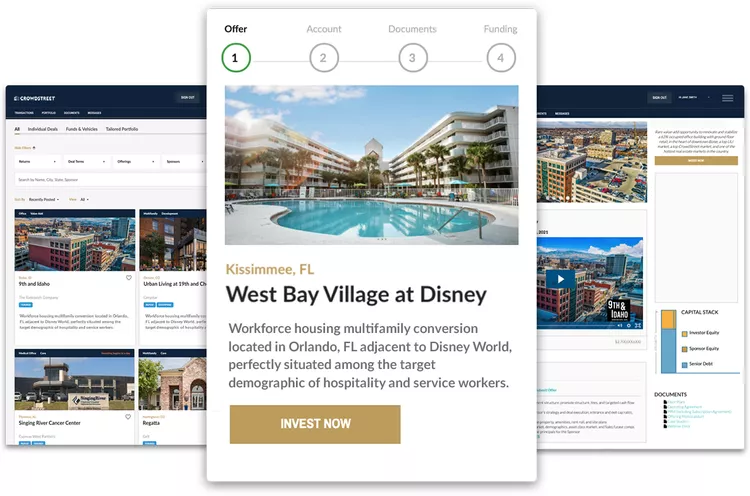

Younger investors, like Millennials, are interested in alternative investments, especially as famous people like Matt Damon and Reese Witherspoon discuss their advantages. You can try out alternative investments using crowdfunding apps like Fundrise and Crowdstreet. Private funds, publicly traded real estate investment trusts (REITs), and managed ETFs also offer ways to invest in alternatives.

Alternative Investments vs Stocks

Many investors are familiar with the potential returns of investing in individual stocks, stock market ETFs, and mutual funds. Over the past century, the U.S. stock market has seen an average annual return of over 9%. However, there have also been years with significant declines, like the -18.01% drop in 2022 and the -36.55% crash in 2008.

Investing in the stock market offers strong potential performance, easy access, and liquidity, making it an important asset class for long-term investors.

However, investors are also looking for alternatives to investing in stocks and assets that aren’t closely tied to the stock market, increasing the demand for alternative investments. Depending on the type of alternative investment, average returns can range from 5.0% for a debt fund to double-digit returns for certain real estate partnerships and other niche alternative investment products.

Alternative investments and stocks have some significant differences:

| Key Differences Between Stocks and Alternative Investments | ||

|---|---|---|

| Stocks | Alternatives | |

| Liquidity | Extremely liquid; can trade throughout the day. | Lots of investments come with lock-up periods, which means your money is stuck for a while, ranging from a few months to several years. |

| Fees | Fee-free trading with most brokerages; most ETFs and mutual funds charge less than a 1.0% expense ratio | Fees for investments can be simple or complicated. Some platforms offer low-fee options, while others have more complex fee structures, including additional performance fees. |

| Minimum investment | Fractional stock and ETF shares can be bought on multiple investment platforms for as little as $10 | Platforms cater to accredited and non-accredited investors, with investment minimums starting as low as $10 and going up to four to five figures. |

| Correlation | Stocks exhibit distinct correlations among specific sectors and geographic regions. Lower correlations between assets lead to more price stability within your investments. | Alternative investments can have relationships with each other, but they don’t always move together. The connection between stocks and alternatives varies based on the time and the specific alternative investment. |

Including alternative investments in a mix of stocks and bonds can help reduce portfolio ups and downs and may increase potential earnings. But remember, investing always involves risks, and there are no guarantees.

How to Buy Alternative Investments

Purchasing alternative investments depends on the platform and the type of assets you’re interested in. If you’re buying an alternative ETF or mutual fund, you must open an investment brokerage account. On the other hand, if you’re purchasing alternatives through a separate company like Cadre, Peer Street, Realty Mogul, or Arrived, you’ll need to follow their specific account setup instructions.

Here’s a simple guide to buying alternative investments:

1. Sign up for an account: To get started with a trustworthy alternative investing platform like Fundrise, Yieldstreet, or Crowdstreet, you’ll need to sign up and make an account. During this process, you must confirm your identity using a government-issued ID.

2. Link a bank account for fund transfers and confirm payment details. After creating your account, the next step is to connect a payment method. This lets you add money to buy alternative investments. Each exchange might accept different payment methods, so see what’s accepted in your area.

3..Select investment and transfer funds: Once you’ve chosen from the investment options available on the platform, select the assets you want to invest in and specify the number of shares and type of investment. You’ll then be prompted to transfer funds from your linked bank account. If your investment doesn’t use all the transferred money, the extra amount will stay in your account as cash for future investment opportunities.

Some investment offers are only for accredited investors, while others are open to everyone. If the platform is exclusive to accredited investors, you must prove that you meet the accreditation requirements.

Accreditation requirements:

- To qualify, you need to have a net worth of more than $1 million, not including the value of your main home, alone or with your spouse or partner.

- To meet the criteria, you should have earned over $200,000 individually or $300,000 with a spouse or partner in the last two years and anticipate earning the same amount this year.

- Experienced investment expert

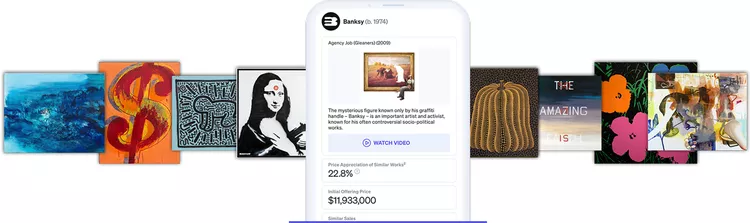

If you’re curious about investing in art or wine, there are different routes to consider. One easy way is using a crowdfunding app like Yieldstreet or Masterworks. Alternatively, you can purchase and trade through specialized dealers or auction houses.

What You Need to Open an Alternative Investing Account

On platforms meant only for accredited investors, you’ll have to provide personal and financial details for verification.

Personal Information

Every platform needs investors to create an account and share basic personal details like:

- “Complete Name”

- “Electronic Mail Address”

- “Contact Number”

- “Residential Address”

- “Confirmation of Residence”

- “National Identification Number”

- “Official Identification Card”

- “Financial Details”

Accredited investors might have to give extra bank or tax records to confirm eligibility.

Minimum Deposits

Minimum deposits can vary widely, ranging from $10 to $20,000. Some platforms set specific minimums for each project. For instance, FarmTogether, only for accredited investors, starts crowdfunding offers at $15,000 and requires a minimum investment of $100,000 for its Sustainable Farmland Fund.

You’ll find reasonable minimums if you invest in alternative ETFs or mutual funds. You can buy fractional REIT shares or commodity ETFs for just a few dollars at Fidelity and other investment firms.

Best Alternative Investing Platforms

| Company | Focus | Minimum Investment |

|---|---|---|

| Fundraise | Real Estate Investments | $10 |

| Masterworks | Art Investments | $15,000 |

| Yieldstreet | Asset Variety | $5,000 |

| iTrustCapital | Gold and Cryptocurrency | $1,000 |

How to Gain Exposure to Alternative Investments Through ETFs

ETFs, or exchange-traded funds, are open to all types of investors, whether accredited or not. Alternative ETFs are available, such as mergers, arbitrage, risk parity, crypto, metals, real estate, multi-asset, and commodities. You can buy ETFs through traditional investment brokerage firms like Fidelity, Schwab, Vanguard, and E*TRADE. Additionally, many investing apps like M1 Finance, Robinhood, Webull, and Public offer access to ETFs.

Sample alternative ETFs include:

- RSBT ETF (Return Stacked Bonds and Managed Futures)

- TPMN ETF (Timothy Plan Market Neutral)

- NOPE ETF (Noble Absolute Return)

- RPAR ETF (RPAR)

- MRGR ETF (ProShares Merger)

- BITO ETF (Bitcoin Strategy)

- GSG Trust (iShares S&P GSCI Commodity-Indexed)

What Are the Advantages of Alternative Investments?

The appeal of alternative investing lies in its potential to have lower connections to stocks and bonds. Pension funds and big investors have included alternatives in their strategies for years. However, categorizing all alternatives together might oversimplify things. Within this broad category, there are various types of investments. For example, commodities can protect your money when prices rise, shielding against inflation. Some investments move in the opposite direction of stocks and bonds, helping to strengthen your finances during market downturns. Others, like hedge funds and private real estate deals, may offer higher returns and less reliance on traditional assets.

If you want to diversify beyond stocks and bonds, alternatives could increase overall returns and reduce volatility. Nowadays, all investors can explore alternative options, although some argue that the best opportunities are reserved for wealthy accredited investors.

What Are the Disadvantages of Alternative Investments?

“Investing in alternative options like private funds comes with risks. These investments aren’t always regulated by the SEC, making them riskier. While they may promise higher returns, there’s also a higher chance of losing money. Unlike traditional mutual funds or ETFs, alternative investments may have less experienced managers and complex tax reporting, leading to extra headaches.

Additionally, many alternative investments tie up your money for a long time and can be hard to sell quickly. Some of the best deals are only available to wealthy investors, and fees for these investments can be high. Unlike stocks or bonds, alternative investments like art or wine don’t generate regular income. So, while they offer growth potential, they may not suit everyone’s investment goals.”

What You Need to Know About Secondary Markets

“Many alternative investments have a solution for their lack of quick cash. They provide secondary markets where you can buy or sell assets after the original purchase. This differs from the primary market, where you buy something new, like when a company first sells its stocks.

Regular investments like stocks and bonds are easy to buy and sell on public exchanges. Some alternative investments have platforms where you can find buyers interested in less common assets. Before investing, know how quickly you can turn your investment into cash.”

What to Consider When Investing in Alternative Assets

Objectives

“Many financial experts advise assigning a purpose to your money. When you start investing, it’s important to have a plan that includes:”

- “Objective for the funds”

- “When you’ll require it.”

- “Your tolerance for risk”

“After figuring out what you want to achieve, how long you have, and how much risk you’re comfortable with, you can assemble your investment mix. If you’re interested in alternative investments like real estate or private equity and are okay with their risks and the time it takes to sell them, you might include them along with stocks and bonds in your investment plan. A few alternative investments in a diverse portfolio are usually recommended to spread the risk.”

Liquidity

“Only put money into the financial markets if you won’t need it for the next three to five years. This applies to stocks, bonds, and alternative investments. While stocks and bonds are easy to sell quickly, many alternative investments take months or years to cash out.

When considering alternative investments, ensure you understand how easy it is to get your money back. Some private investments, especially for wealthier investors, might need a minimum investment of tens or hundreds of thousands of dollars and could tie up your money for up to 10 years. Check if there’s a way to sell your investment early and if you’re okay with waiting that long before you buy.”

Setting Your Time Horizon

“Know what you want your money to do. Are you aiming for long-term growth, regular income, or keeping it safe and accessible? Money meant for short-term needs like a vacation or buying a house soon shouldn’t be put into alternative investments because they’re hard to turn into cash quickly.

Once you’re clear on your goals and when you’ll need the money, you can see if a specific alternative investment fits your plan. Check all the investment details and ensure the time you want to keep your money matches how long you might have to wait to get it back. Usually, it’s best to plan on holding onto alternative investments for a while.”

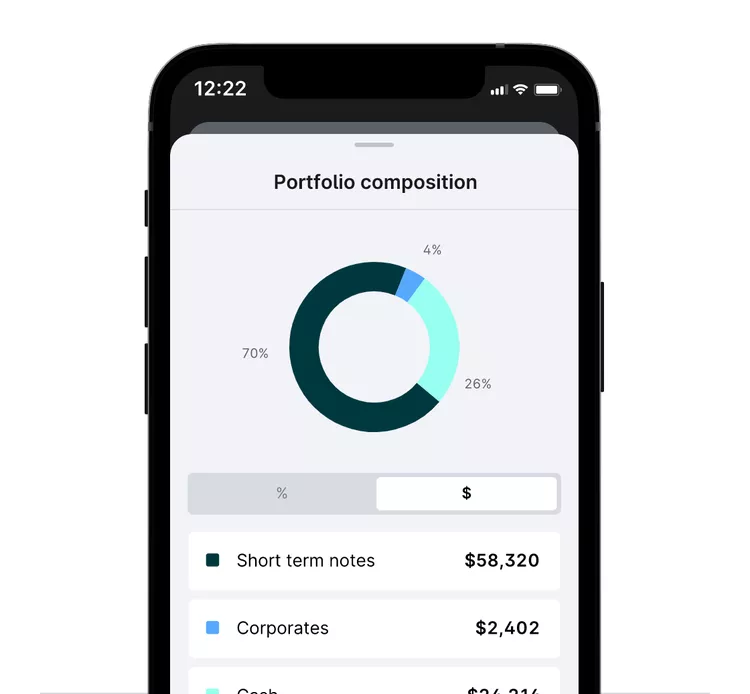

Building a Diversified Portfolio

“To build a varied investment plan, start by setting your goals, how long you have, and how comfortable you are with risk. Based on these factors, you can decide if you want a safe plan with fewer risks and quicker returns or a more daring one with higher potential returns but more ups and downs. Typically, safer plans have more bonds and cash, while riskier ones focus more on stocks.”

“Many investment plans set aside a bit of money for alternative options, which are riskier. It’s usually advised to keep less than 10% of your easily accessible money in these riskier choices, like alternatives. The risk you take affects how much you might gain or lose. Riskier plans might make more money but have bigger ups and downs. Safer plans usually earn less but have steadier results.”

FAQs

1. What Are Alternative Investments?

Ans: Alternative investments cover many assets beyond regular stocks and bonds.

They’re any investments other than individual stocks and bonds, funds made up of stocks and bonds, or cash assets like CDs or money market funds. Some examples include real estate, commodities, currencies, hedge funds, and other special assets.

2. What Are the Most Popular Forms of Alternative Investment?

Ans: With the rise of crowdfunding apps for alternative investing, there are many options for those interested in alternative assets.

If you’re looking to invest beyond stocks, here are some alternative investment ideas:

- Commodities

- Real estate: REITs, private, crowdfunding

- Metals – including gold and silver

- Art

- Wine

- Private debt

- Hedge funds

- Cryptocurrency

- Farmland

- Currencies

- Private Equity

- Startups

3. Should I Buy Alternative Investments?

Ans: You can create a well-rounded investment mix without including alternative options. Whether you invest in alternatives depends on your financial goals, how much risk you’re comfortable with, and how long you plan to invest. There are a few reasons why you might want to consider alternative investments:

- You’re looking for a chance to invest alongside big institutions and wealthy individuals.

- You’re okay with taking on some risk.

- You don’t need the money right away.

- You want the chance to make more money.

- You want to spread out your investments more.

Ultimately, deciding if you want to invest in alternative options is up to you.