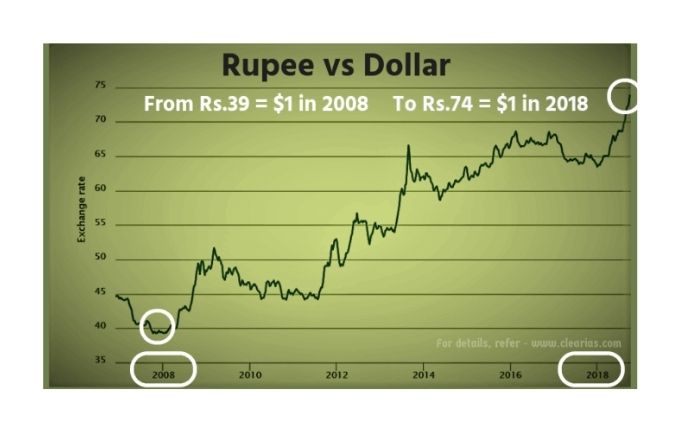

When I am writing the blog, the value of One Dollar is Equals to 74 Rupees, and there may be questions arising in everyone’s mind why so? Devaluation is the reason behind it. Because of the devaluation of the Indian rupee with the dollar, and there is a difference in values.

Can 1 Rupee Is Equal to 1 Dollar? If yes, how does this affect our lives? It’s an interesting ongoing game with the US Dollar and INDIAN Rupee.

Let’s start with the absolute basic—the Conversion Rate Between Two Currencies called the Exchange Rate. There Are mainly three types of exchange rates.

- Fixed Exchange Rate: That Means The Government determines the Exchange rate and conversion rate of currencies called the Fixed Exchange Rate.

Ex: Indian Government Determined The Conversion Rate and Exchange Rate of Rupee. - Floating Exchange Rate: The Exchange Rate Of the Currency keeps on changing based on the supply and demand in the market. That Called the Floating Exchange Rate. Let’s Understand It With the below Example.

Ex: Suppose you and I live alone on two islands; we grow different things on our island. I grow tomatoes on my island, and you grow onions on your island. Both of us create our currency. My currency name is tomato coin, and I have 100 Tomato coins; and you make your currency name is onion coin, and you have your 100 Onion Coins. We decided that our currencies’ exchange rate and conversion rate would be 1:1, so 100 tomato coins should be equal to 100 onion coins.

After some months, I work hard, and I grow 200 tomatoes, and you grow only 100 onions. Suddenly my currency value has increased because I still have only 100 tomato coins. So for me, the value of one coin has become 2 Tomatoes, and if you want to exchange it with me, then the value of 1 tomato coin has become equal to 2 onion coins.

Now Understand the second example: Suppose You Grow Tomatoes and create pizzas from the use of tomatoes. Now Someone comes to your island, and he wants to eat pizza. Then you tell him that if you want to eat pizza, it can be bought with your currency only(tomatoes coins), then he bought your tomato coin, and if he bought your tomatoes coin, then the value of tomatoes coins will go up. - Managed Exchange Rate: The Exchange Rate is partially allowed to fluctuate; the Government doesn’t allow more than 1 to 3 percent fluctuations. So In This System exchange rate is neither fixed nor free That Called Managed Exchange Rate.

There Are many reasons for the fluctuations in the value of the currencies.

- Unemployment Rate.

- Inflation Rate.

- The GDP Of A Country.

- Manufacturing activities in a country.

- The Types of products produced in the Country.

- . How is The Export and Import of The Country?

Why did the Rupee get so devalued after it?

Before 1970 Most of the countries had Fixed exchange rates, even India. When India got independence in 1947 then,$1 was equal to 1 Rupee. It was the time when $1 was equal to 1 Rupee. But Why did the Rupee get so devalued after it? Let’s understand it.

Before the 1950s, the Indian Government spent lots of money on the Country’s development but didn’t earn as much. So The Government takes several loans from other countries. Since the Government didn’t have enough money to repay the loans, the Government devalued the money.

In the 1960s and 1970s, there had been several wars, indo-pak wars, and indo-china wars. Our Country suffered heavy losses again. The Country needs foreign investment to boost the economy, and the foreign investment would’ve come only if there were incentives in the Country; there were incentives such as cheap products for investing in the Country. Because of this, the Government changed the exchange rate again, wherein 1$ was around 1 Rupee.

In 1973, There was a massive oil crisis globally. Because of this, the oil import by India was so expensive. Driving this, the value of Indian rupees goes down.

After this, the prime minister of India, Indra Gandhi, was assassinated, and the confidence of foreign investors in the Indian economy shattered, so by the time we got to 1990, $1 was equal to 17.50 Rupee.

After This biggest shock to the Indian economy was in 1991, A heavy fiscal deficit was seen. The Country went through economic liberalization, and the Indian Govt. kept on the Rupee floating exchange rate till 1994. Then the changes in the demand and supply in the market led to a change in the Rupee value.

There Are too many factors I told you about the main reasons.

When the Government devalued the currency on its own, for any reason, by increasing the supply, it’s known as Devaluation.

How Does Devaluation Work? Let’s Understand it in the below example?

Ex: Suppose I take a 100 rupee loan from you and spend all of it, and I have left only 25 Rupees, so how will I repay the loan when I don’t have 100 Rupees? But Remember That I control the Rupee. I can control the Rupee value because I’m in the Indian Government, so what I do is that I start printing more money then the supply of the Rupee is increased, but the value of rupees is going down.

If I print so much money, That 10 Rupees now has the same value as 1 Rupee. Then it’s been devalued so much. So That 25 Rupees, I have become 250 Rupee OverNight and repay 100 Rupee to you out of 250 Rupee Effectively paying off the loan. This is how the Devaluation of currency works.

So what will be the effect of equal value of Rupee and USD.

- It would be very easy for you to vacation abroad.

- The Luxury goods that you would’ve bought from other countries like an iPhone. An iPhone would’ve cost you only 600 Rupee.

- Import price would’ve been meager like petrol price would’ve been very low.

- Had You go abroad to study, it would’ve been very inexpensive.

Now, After this, you think if $1 is equal to 1 rupee, then life comes so much easier and so many goods are available at the cheapest rate, and everything would be cheaper. That would be an excellent thing, but now comes the reality check.

If $1 is equal to 1 Rupee? Then it would also mean that no foreign investors will come to India, or a negligible amount of foreign investment might come in because the foreign investors will invest in India because of cheap labor work. It is much cheaper to employ people in India as compared to western countries.

So if the foreign companies see that he pays 35000$ to American employees and pays 35000$ to Indian employees, why invest in India when he does not earn so much? He is going to employ some other country employee because he will take a cheap payment per annum.

In India approx 60% of the contribution is from the Services sector, and the service sector provides 32% of employment in India. And what is the service sector, mainly the IT(Information Technology) sector? This IT sector Employment comes from foreign investors who are open to their own offices and call center, and WHAT IF $1 EQUAL TO 1 RUPEE then the Indian employment becomes too expensive then they will shut down their offices and call center will leave the Country. Those who are into the employee sector then become unemployed. This will lead to large-scale unemployment in the Country and as well as economic crisis.

Something similar to this happened in the 2008 world economic crisis. Because of this, India faces too much unemployment in the IT sector.

After this situation leads to a fundamental question.

What is a good Week Rupee Or a Strong Rupee?

This question is not easy to answer because export-oriented companies prefer a low currency value, and import-oriented companies prefer a high currency value.

Export-Oriented: That Means Send The Good From Our Country To Any Other Country Called Export Oriented.

Like:-China Always prefers Low Value Of Currency Because China is an Export Oriented Country.

Import-oriented: That Means Receive The Goods From Any Other Country To Our Country That Called Import-oriented.

Like:-India Always prefers a high value of the currency, but India is not only an import-oriented country. India is also an Export-oriented country.

India Is A Import-Oriented Country Or Export-oriented Country

As per the above graph, India is imports oriented Country Because India imports too many goods compared to Exports Goods. If India imports the goods, then India always prefers the high value of the currency.

But wait a minute, As per the below graph, India’s economy is primarily dependent on the IT Sector, and India exports IT(Information Technology) Works from any other country, so India prefers a low value of Rupee.

India is an import-oriented and export-oriented country. So what is good for India is a low value of currency or a high currency value. It is one of the most controversial things in India.

Some Economists say that the low value of rupees is good for India, but some economists say that the high value of rupees is good for India, so now what is the solution?

What Are The Solution Here?

India is primarily dependent on imports, so India should try to reduce imports. Now Here Come so many questions, how is it possible?

- Increase The Transportation facility and services so people can travel by train, metro train so because of this oil uses will come low and India Will reduce the oil imports.

- Indian Government should promote the Industries in India.

- Try To Increase Exports.

Over to You

For similar articles, visit Seben Capital Website; you may find the best information on Capital Market, Insurance, Credit Repair, and Loan services. Also, follow us on Instagram and join our Telegram channel.