In this article

1. Summary

2. Why should you pursue B.Com?

3. Best Career Options After B.Com

4. Future Scope of B.com

5. Conclusion

Summary:

- MBA (Master of Business Administration from Deakin Business School)

- CA (Chartered Accountancy)

- CS (Company Secretary)

- M.Com (Master of Commerce)

- CFA (Chartered Financial Analyst)

- BAT (Business Accounting and Taxation)

- CMA (Certified Management Accountant)

- CPA (US Certified Public Accounting)

- FRM (Financial Risk Manager)

- ACCA (Association of Chartered Certified Accountants)

- Certified Financial Planner

- CIB (Certificate in Investment Banking)

- B.Ed (Bachelor of Education)

- Digital Marketing

- Government Exams

- Insurance

- Wealth Management

“What to do after B.Com?”

For many students, completing a Bachelor of Commerce (B.Com) degree is the first step towards a successful career. While a B.Com degree provides a strong foundation in business and finance, it’s often essential to further your education and skills to secure high-paying and rewarding jobs. This blog post is here to help you navigate the various career options and courses available after B.Com, giving you the insights you need to make informed decisions for your future.

The Importance of Post-Graduation or Professional Certificates

A B.Com degree is undoubtedly a valuable asset, but in today’s competitive job market, it’s often insufficient to guarantee a prosperous career. To establish a strong foothold in your chosen field, you’ll find it beneficial to pursue post-graduation or professional certification programs. These advanced studies enhance your knowledge, skills, and employability, increasing your chances of landing high-paying positions.

Short-Term Courses After B.Com

Short-term courses can be a great way to supplement your B.Com degree and unlock new career possibilities. These courses are designed to arrange specific knowledge and practical skills that align with industry demands. You can explore various short-term courses after B.Com to boost your job prospects and earning potential.

Career Options After B.Com

What career paths are available to you after earning your B.Com degree? Here are some of the popular options:

- Chartered Accountant (CA): Pursuing the CA designation can open doors to high-paying positions in the financial sector if you have a strong aptitude for accounting and finance.

- Certified Management Accountant (CMA): Becoming a CMA allows you to excel in management accounting and financial management roles.

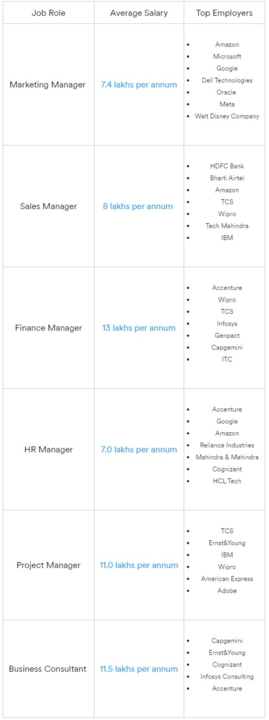

- Master of Business Administration (MBA): An MBA (Master of Business Administration) can lead to various managerial and executive positions in various industries.

- Certified Public Accountant (CPA): Ideal for those interested in international accounting and finance careers.

- Certified Financial Planner (CFP): CFPs help individuals and organizations plan for their financial futures.

- Financial Analyst: Analyze financial data, assess investment opportunities, and provide insights to businesses and investors.

- Business Consultant: Offer strategic advice and solutions to organizations seeking to improve their performance and profitability.

- Entrepreneurship: Use your B.Com knowledge to start and run your own business.

These are just a couple of examples, and you can explore many other career paths based on your interests and skills.

In Conclusion

Your B.Com degree is a valuable stepping stone towards a successful career, but it’s often wise to consider further education and specialization to achieve your career goals. The world of business and finance is vast, offering numerous opportunities for those prepared to invest in their education and skills.

Remember, your choice of courses after B.Com should align with your passions and career aspirations. Whether you aspire to be a financial expert, a business leader, or an entrepreneur, the right path is out there for you.

So, if you’re wondering, “What can I do after B.Com?” – rest assured that countless options await the time to explore the possibilities, discover your passion, and invest in your future success.

Why should you pursue B.Com?

The world of Education offers a variety of undergraduate degrees, but pursuing a Bachelor of Commerce (B.Com) comes with unique advantages that cater to a large range of interests and career aspirations. Let’s delve into the positive aspects of choosing B.Com courses over other undergraduate degrees:

- Entrepreneurial Preparation: Unlike Bachelor of Business Administration (BBA), which mainly focuses on preparing students for managerial roles, B.Com is a versatile degree that equips candidates for the corporate world and entrepreneurship. It nurtures a spirit of entrepreneurship, fostering creativity and business acumen.

- Strong Foundation in Business and Finance: B.Com provides a robust foundation in business and finance, empowering candidates with knowledge that can be applied to excel in their careers or business ventures. The comprehensive curriculum covers various aspects of the business world.

- Versatile Domain: B.Com degree holders enjoy a vast and versatile domain compared to other degrees. They can find opportunities in diverse sectors such as marketing, accounting, consultancies, investment banking, banks, and capital management, and more knowledge and skills gained are transferable across various industries.

- Diverse Academic Exposure: B.Com graduates are highly sought after by organizations due to their diverse academic exposure. Their education covers a wide spectrum of subjects, making them adaptable and capable of handling various job roles and challenges.

- Competitive Entry-Level Salaries: B.Com degree holders often command higher entry-level salaries than those from other fields. This reflects employers’ value on the skills and knowledge acquired during B.Com studies.

- Advanced Skill Enhancement: Many short-term courses are designed to assist B.Com graduates in obtaining advanced and industry-relevant skills. These courses are valuable add-ons, allowing graduates to stay competitive in the job market and further specialize in their chosen fields.

In Conclusion

Pursuing a B.Com degree is wise for those passionate about business, finance, and entrepreneurship. The advantages of a B.Com degree are numerous, and they provide graduates with the flexibility to discover many career opportunities.

Whether you aspire to be a future entrepreneur, a finance expert, or a versatile business professional, B.Com sets the stage for success. It equips you with the knowledge, skills, and diverse exposure necessary to thrive in the ever-evolving business landscape.

So, if you’re considering your academic and career path, remember that B.Com offers a solid foundation and a world of possibilities for your future. Explore the diverse courses and opportunities available, and take the first step to a rewarding and fulfilling career.

Best Career Options After B.Com

1. MBA (Master of Business Administration from Deakin Business School)

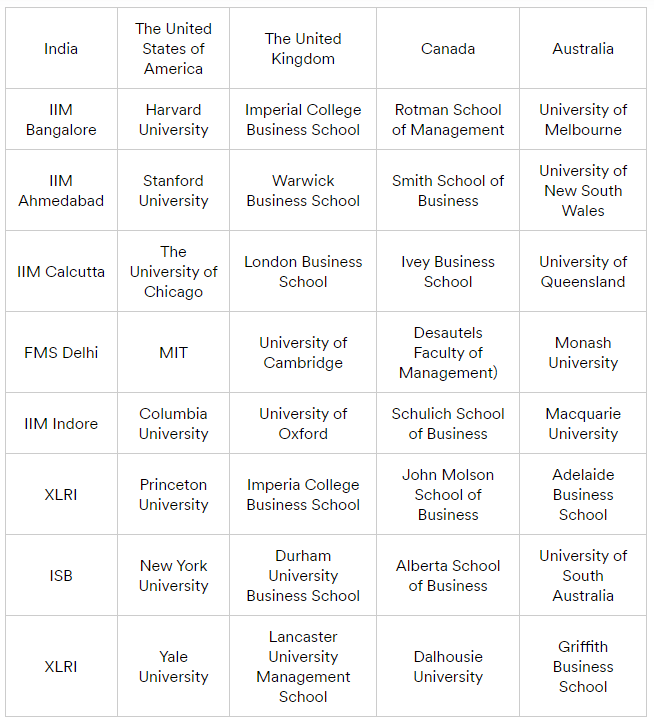

- CAT Examination: To secure a seat in a reputed MBA program, candidates often need to clear the Common Admission Test (CAT). Your CAT score determines the college or university you can enroll in. With its diverse specializations, an MBA opens up opportunities for commerce graduates and students from other fields.

- Timing Matters: While an MBA is undoubtedly one of the best professional options after B.Com, gaining 2-3 years of work experience is often recommended before pursuing this advanced degree. Practical work experience complements your academic knowledge and equips you to apply theory to real-world situations.

- Flexible Learning Options: For those unable to commit to a full-time MBA for various reasons, flexible alternatives are available. UpGrad, in collaboration with the Deakin Business School, offers a comprehensive MBA program that allows you to balance your career and education. Deakin is among the top 10 B-Schools in Australia, and this Program provides the same degree as full-time on-campus students. Furthermore, Deakin’s MBA program offers dual qualifications with an IMT Ghaziabad certificate and a Deakin MBA degree, enhancing your credentials.

- High Demand and Competitive Salaries: Completing an MBA opens doors to opportunities in various multinational companies. Fresh MBA graduates are in high demand, and starting salaries range from 5 lakhs per annum to 25 lakhs per annum. The Institute you graduate from plays a significant role in determining your earning potential. Choosing an institution with a strong reputation is essential to maximize your career prospects.

- International Opportunities: For those seeking an international degree while staying in their home country, upGrad offers the Masters of Business Administration in collaboration with the Golden Globe University, San Francisco. This Program caters to working professionals, allowing them to enhance their skills while continuing their careers.

In Conclusion

An MBA is a transformative step that can elevate your career to new heights. It equips you with advanced knowledge, leadership skills, and the ability to navigate the complex business world. With various specializations available, you can tailor your MBA to align with your passions and career aspirations.

So, an MBA is one of the best choices if you’re considering your educational and career path after B.Com. This decision can lead to a rewarding and dynamic career in various industries and sectors. Explore your options, evaluate your career goals, and embark on your journey towards a successful future.

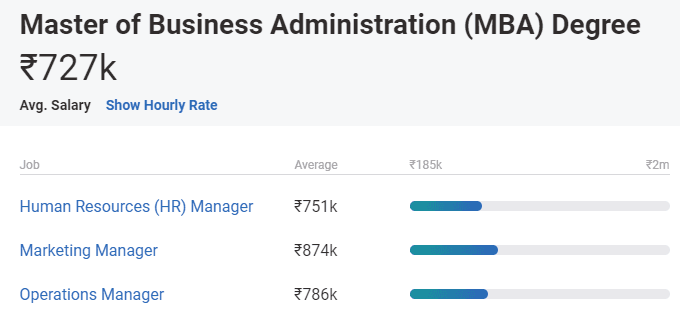

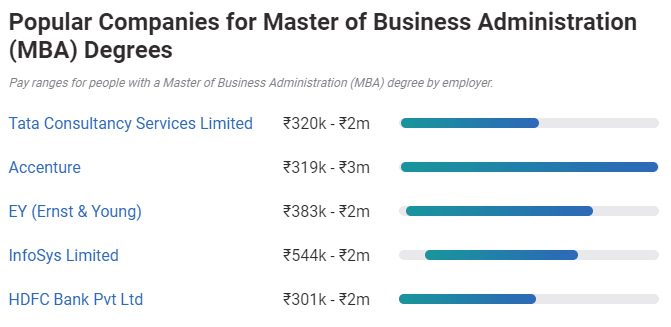

According to Payscale, the average earnings of MBA graduates in India is 7.2 LPA.

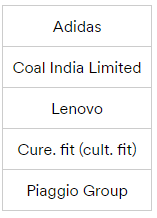

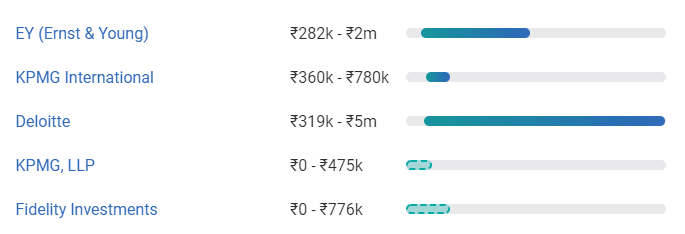

List of Most Popular Firms for MBA Graduates:

Source

Based on the expertise and domain the professional wishes to pursue, the choices increase for them. Some of those are mentioned below-

2. Chartered Accountancy (CA)

For many commerce students, Chartered Accountancy (CA) is often the first and most prominent choice when considering career options after completing B.Com. CA is widely regarded as one of the best and most prestigious career paths, offering many opportunities. Let’s delve into the world of CA and explore why it is considered a prime choice:

- Early Start: Unlike an MBA, which typically requires prior work experience, students can embark on their CA journey immediately after high school. This means that you can set your sights on becoming a chartered accountant right after school, making it an attractive option for those who are certain about their career path from an early stage.

- Staged Progression: The CA journey consists of three stages: CPT (Common Proficiency Test), IPCC (Integrated Professional Competence Course), and CA Finals. Each stage is designed to provide a comprehensive understanding of accounting, finance, taxation, and related subjects. Completing these stages, along with a mandatory internship of 2.5 years, leads to the prestigious title of a certified chartered accountant.

- Diverse Career Options: Career opportunities open once you attain your CA qualification. You can explore roles in multinational companies such as EY or Deloitte, working in critical positions in finance and auditing. Alternatively, you can establish your own CA firm and offer your expertise to clients. The versatility of this qualification makes it one of the best courses after B.Com.

- Duration: The CA course typically spans three years, encompassing the stages mentioned earlier. The dedication and effort invested during this time led to a rewarding and prestigious qualification.

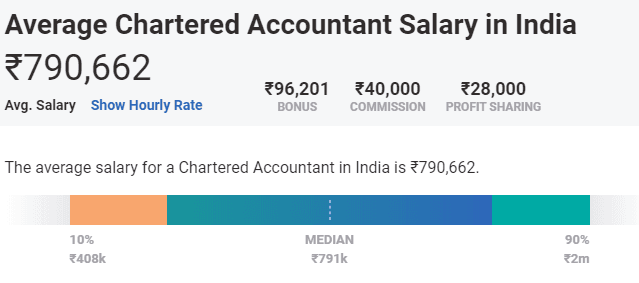

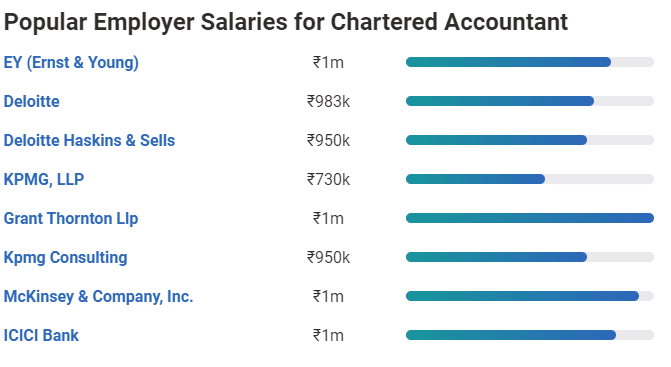

- Competitive Salaries: CA graduates are highly sought after, and this demand is reflected in the competitive salaries they command. On average, CA graduates in India earn an impressive annual salary of Rs. 7.9 Lakh per annum.

In Conclusion

Chartered Accountancy is not just a career path; it’s a journey of excellence in finance, accounting, and auditing. CA is a top choice for those passionate about numbers, possess a meticulous eye for detail, and are committed to supporting the highest professional standards.

The opportunities that come with this qualification are vast and diverse. Whether you work for a leading corporation, launch your practice, or explore other financial avenues, CA equips you with the knowledge and skills to excel.

If you’re a commerce graduate contemplating your future, consider the remarkable path of Chartered Accountancy. It’s a journey that offers prestige, financial rewards, and the opportunity to significantly impact the world of business and finance.

The average earnings of CA graduates in India is Rs. 7.9 LPA.

Top employers for CA graduates:

Source

Eligibility to pursue CA- Post accomplishment of 12th or after Graduation

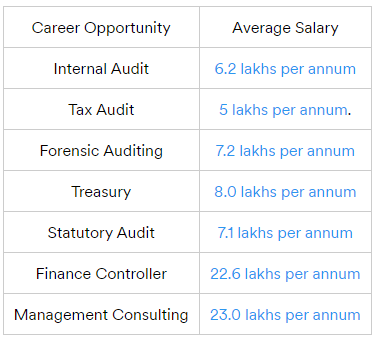

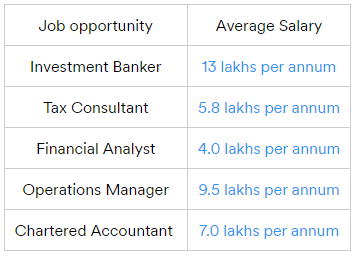

Career Opportunities and Earnings are projected for Chartered Accountants-

- Internal Audit

- Tax Audit

- Forensic Auditing

- Treasury

- Statutory Audit

- Finance Controller

- Management Consulting

3. Company Secretary (CS)

For those who’ve completed their B.Com degree and are pondering the question, “What to do after B.Com?” Company Secretary (CS) is a pivotal and prestigious organizational role. A Company Secretary is a key member of the C-suite, working alongside the CEO and CFO, and plays an important role in managing the legal aspects of a firm or organization.

Let’s delve into the world of Company Secretary and understand why it’s considered one of the best career options after B.Com:

- Legal Stewardship: Company Secretaries are entrusted with the legal stewardship of a company. They confirm the organization complies with all relevant legal and statutory regulations. This involves managing tax returns, maintaining tax records, and providing valuable legal advice to the board of directors.

- Education Path: To embark on the journey to become a Company Secretary, candidates must pursue a degree in corporate law. This degree typically spans three years and consists of three stages: Foundation, Intermediate, and Finals. The comprehensive curriculum equips individuals with the knowledge and expertise needed to excel in this role.

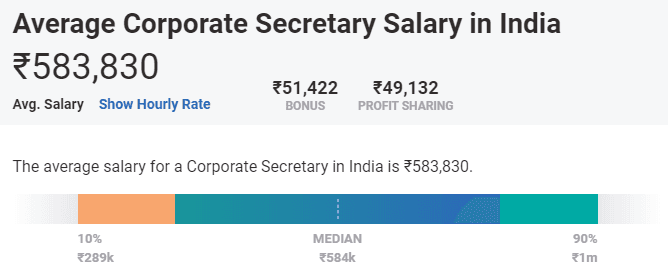

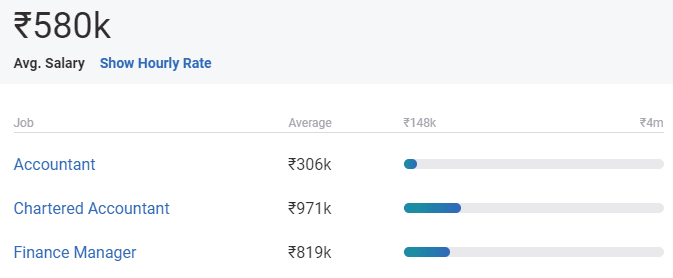

- Competitive Salaries: The career path of a Company Secretary in India offers attractive remuneration. The salary range for CS professionals in India varies between Rs. 4 to 10 Lakh per annum. According to PayScale, the intermediate salary of a Company Secretary is around Rs. 5.8 Lakh per annum. This makes CS one of the most lucrative and rewarding career options after B.Com.

In Conclusion

Becoming a Company Secretary is not just a career choice; it’s a commitment to upholding an organization’s legal integrity and financial health. CS professionals are indispensable in navigating the complex world of business regulations, ensuring companies comply with the law.

For B.Com graduates seeking a career path that combines legal expertise, financial acumen, and leadership, Company Secretary is an attractive option. It offers prestige, financial rewards, and the opportunity to impact an organization’s legal and financial well-being significantly.

If you’re contemplating your next steps after B.Com and are drawn to corporate law and governance, consider the path of a Company Secretary. It’s a career that combines responsibility, excellence, and financial success, making it a compelling choice after your B.Com journey.

Source

Learn MBA Courses from the world’s best Universities. Get Master, Executive PGP, or Advanced Certificate Programs to accelerate your career.

Eligibility to Chase Company Secretary- Graduation

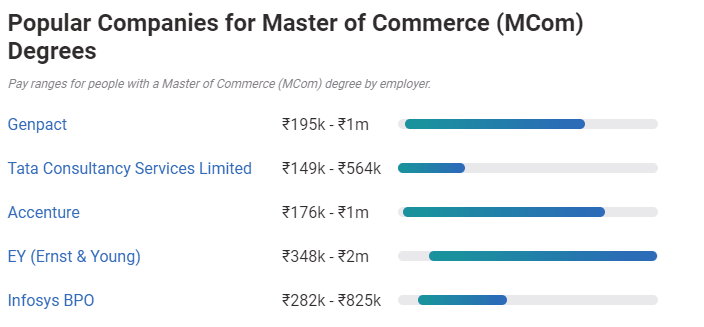

Some of the job opportunities after the company secretary course-

Top Employers Recruiting Company Secretary

4. Master of Commerce (M.Com)

M.Com, short for Master of Commerce, is a postgraduate degree that takes you deeper into commerce, economics, and business. This two-year Program is offered by government-recognized universities and colleges across India, allowing you to further your education after completing your B.Com.

Let’s explore the key aspects of M.Com and how it can enrich your understanding of the concepts you studied as a B.Com student:

- Broad Specialization: M.Com offers a comprehensive specialization beyond commerce. It encompasses accounting, business management, economics, banking and finance, finance and control, taxation, and more. This broad spectrum of subjects ensures that M.Com graduates possess a well-rounded knowledge base that can be applied in various industries.

- Career Opportunities: M.Com is ideal for individuals aspiring to build careers in the BFSI (banking, financial services, and insurance) and the accounting and taxation sectors. The Program equips you with the advanced skills and knowledge needed to excel in these industries and take on leadership roles.

- Deepening Your Understanding: M.Com allows you to delve deeper into the concepts you encountered during your B.Com studies. You’ll gain a more profound understanding of commerce and its intricate components, preparing you for complex challenges in the professional world.

In Conclusion

M.Com is a valuable postgraduate program that elevates your education in commerce and related fields. It opens doors to diverse career opportunities and provides you with the expertise needed to excel in the BFSI sector, accounting, taxation, and other industries.

If you’re eager to expand your knowledge and embrace new career prospects, M.Com is a logical and promising choice. It’s a journey of academic growth and specialization that can lead to a fulfilling and prosperous career.

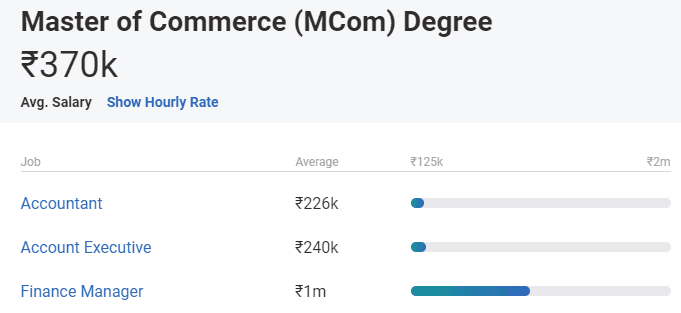

The average salary of M.Com graduates in India is Rs. 3.7 LPA.

List of best companies hiring M.Com graduates:

Source

The career opportunities and earnings may differ for M.Com graduates with experience. The average earnings for the M.Com graduates are mentioned below.

5. Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) selection is a globally respected professional certification offered by the CFA Institute. This prestigious credential is designed to evaluate and affirm the competence and integrity of financial analysts.

If you’re looking for an excellent choice for promising post-B.Com job prospects and attractive salaries, the CFA:

- Course Duration: The CFA course typically spans 2.5 years, during which candidates undergo rigorous training and examinations to master advanced investment analysis.

- Comprehensive Curriculum: The CFA curriculum covers a wide spectrum of topics in the realm of advanced investment analysis. These topics include statistics, economics, corporate finance, security analysis, financial analysis, probability theory, fixed income, derivatives, alternative investments, and portfolio management. Knowledge base prepares you for diverse roles in the finance industry.

- Three-Tier Exam: To earn the prestigious CFA designation, candidates must complete a three-tier examination process. These exams are challenging and rigorous, ensuring that CFAs are well-versed in the complexities of finance and investment.

- Career Opportunities: The CFA is widely recognized as the gold standard in the financial industry. CFAs are in high demand and are often recruited by leading financial institutions such as JP Morgan, UBS, Goldman Sachs, BlackRock, Morgan Stanley, and the Royal Bank of Canada. This credential opens doors to top-tier career opportunities.

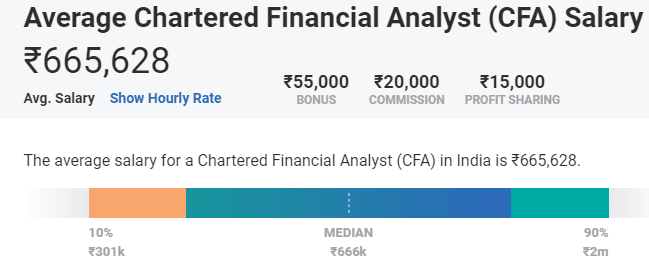

- Competitive Salaries: The average salary of a Chartered Financial Analyst in India is around Rs. 6.6 Lakh per annum. This substantial earning potential, combined with the global recognition of the CFA designation, makes it one of the most alluring career paths after B.Com.

In Conclusion

The CFA demands dedication from individuals passionate about finance, investment analysis, and managing financial portfolios, but the rewards are significant. The CFA designation is not just a professional qualification but a symbol of duties and excellence in finance.

If you have a career that offers intellectual challenges, global recognition, and attractive financial rewards, consider the path of a Chartered Financial Analyst. It’s a decision that can shape a dynamic and prosperous career in the finance industry.

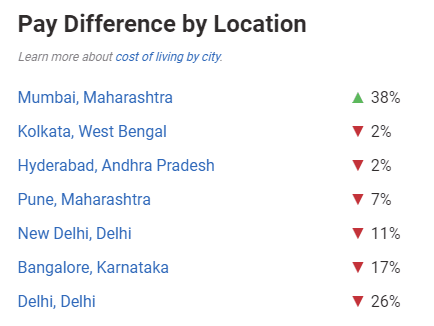

How the city you work affects your pay:

6. Business Accounting and Taxation (BAT)

If you’re still exploring your options after completing your B.Com degree, the Business Accounting and Taxation (BAT) Course could be the path to a promising career. This meticulously designed Program, crafted by industry experts, is tailored to prepare B.Com graduates for thriving careers in accounting and taxation. Let’s delve into the world of BAT and understand why it’s considered one of the best post-B.Com courses:

Key Highlights of BAT:

- Industry-Ready Curriculum: The BAT Course is meticulously designed to ensure you are industry-ready for accounting job roles. You’ll engage in practical and experiential learning, equipping you with the knowledge and skills needed to excel in the accounting and taxation industry.

- In-Demand Tools: This Program goes beyond theory and covers some of the most sought-after tools in the accounting and taxation field. You’ll master essential tools and software critical in today’s job market.

- Comprehensive Learning Modules: The course modules include a wide range of topics, such as financial reporting using ERP (Enterprise Resource Planning) software, goods and service tax (GST), finalization of financial statements, direct taxation, payroll components like ESIC (Employee State Insurance Corporation), and Excel and MIS reporting.

- Diverse Career Opportunities: Completing the intensive BAT course creates many promising job profiles. You can explore roles such as company law assistant, tax consultant, corporate legal assistant, finance manager, accounts executive, and tax analyst. Thires you have the knowledge and skills to thrive in these roles.

- Clarity for B.Com Graduates: If you’re a B.Com graduate wondering which course is best, rest assured that Business Accounting and Taxation is a stellar choice. It aligns with your academic background and equips you for a successful career in the finance and accounting sector.

In Conclusion

Business Accounting and Taxation (BAT) is a career-enhancing program that bridges the gap between academia and industry. It prepares you for the practical challenges of accounting and taxation roles and equips you with the skills and knowledge to succeed.

If you’re seeking a dynamic career path that offers promising prospects and a clear direction for your future, consider BAT. It’s a decision that can lead to a fulfilling and prosperous career in finance and accounting.

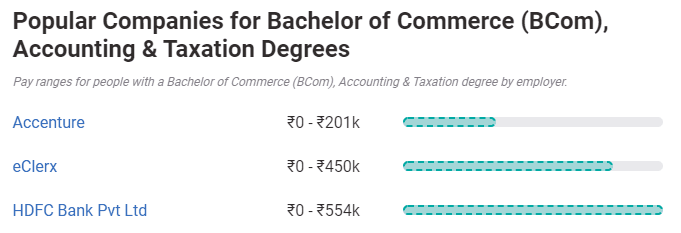

The average salary for BAT skills normally ranges between Rs. 4 LPA.

Top employers

7. Certified Management Accountant (CMA)

If you’re considering a career abroad after completing your B.Com, the Certified Management Accountant (CMA) certification is a path that can open doors to a world of opportunities. This globally recognized professional credential, offered by the Institute of Management Accountants in the USA, focuses on two vital fields: management accounting and financial management. Let’s explore what makes CMA an outstanding choice for post-B.Com career aspirants:

Key Highlights of CMA:

- Global Recognition: CMA is a globally acknowledged certification demonstrating your competence and expertise in critical areas such as financial planning, analysis, control, decision support, and professional ethics. This recognition is invaluable if you aspire to work abroad.

- Dual Certification: Earning CMA certification involves clearing two stages of examination. These rigorous assessments ensure that CMA-certified professionals possess a comprehensive accounting.

- Work Experience Comprehensively: CMA candidates must have two years of relevant work experience along with the exams. This practical exposure ensures that CMA professionals are not only academically equipped but also well-prepared for the demands of the industry.

- Diverse Career Opportunities: After obtaining the CMA certification, you’ll find various employment opportunities in organizations of all sizes and across various industries. Your expertise will highly seek public and private enterprises, not-for-profit organizations, academic institutions, government entities in the USA, and multinational corporations after your expertise, showcasing the global applicability of the CMA credential.

- Clear Career Path: If you’re uncertain which course is best after B.Com, CMA offers a clear and rewarding career path. It’s a well-established qualification that aligns with your educational background and equips you with international career prospects.

In Conclusion

The Certified Management Accountant (CMA) certification is your passport to a global career in finance and management. It’s a path offering extensive recognition, skills, and expertise to excel in the field.

CMA is a standout choice for B.Com graduates with aspirations of working abroad and achieving career excellence. This decision can lead to a fulfilling and prosperous career in organizations worldwide.

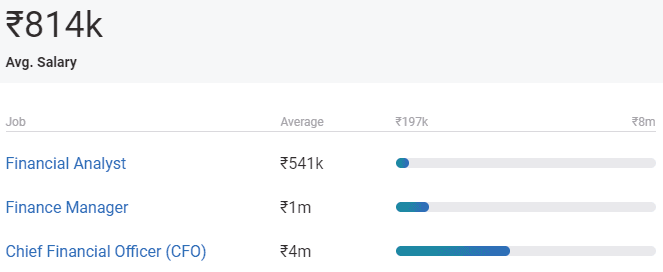

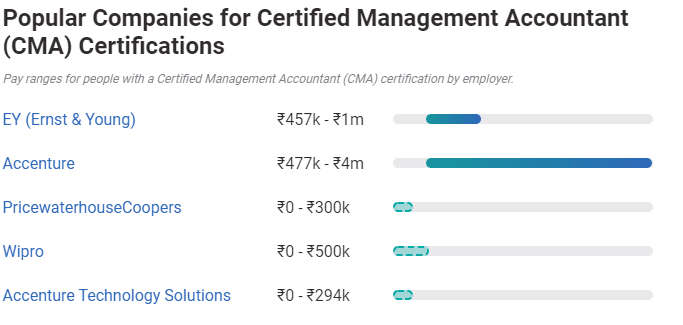

The average earnings of a CMA is Rs. 8.1 LPA in India

List of top employers for CPA

8. US Certified Public Accounting (CPA)

The Certified Public Accountant (CPA) designation is yet another globally recognized professional credential, and it stands as one of the best courses you can pursue after completing your B.Com. Granted by the AICPA (American Institute of Certified Public Accountants), this certification is a testament to your accounting and financial acumen expertise. Let’s explore what makes the CPA certification a stellar choice:

Key Highlights of CPA:

- Rigorous Requirements: To embark on becoming a CPA, you must deeply understand generally accepted accounting principles (GAAP). Earning the CPA license entails comprehensive education, typically involving at least 150 hours of academic coursework and passion and a four-part examination.

- Focused Expertise: CPAs are responsible for critical financial tasks, including preparing financial statement audits and providing attestation services. These services are essential in informing investors about the financial health of companies and firms. CPAs are also crucial in offering corporations and individuals tax advice and financial planning guidance.

- Promoting Informed Decision-Making: A CPA’s primary duty is to provide financial reporting and advisory services that empower informed decision-making and stimulate financial growth. Their role is pivotal in ensuring that financial statements are accurate and trustworthy, instilling confidence in investors and stakeholders.

- Wide-Ranging Career Opportunities: Earning the CPA credential opens many career opportunities in finance and accounting. CPAs are highly sought after in public accounting firms, corporations, government agencies, and non-profit organizations. The demand for CPAs extends across various sectors, reflecting the universal need for their expertise.

In Conclusion

Becoming a Certified Public Accountant is a pursuit that can lead to a distinguished and rewarding career in finance and accounting. This decision is a decision commitment to excellence and your dedication to ding the highest standards in financial reporting and advisory services.

For B.Com graduates, the CPA certification is a remarkable choice for a clear and well-established career path that agrees with their educational background; the CPA certification has the knowledge and skills needed to excel in diverse financial roles and make a significant impact.

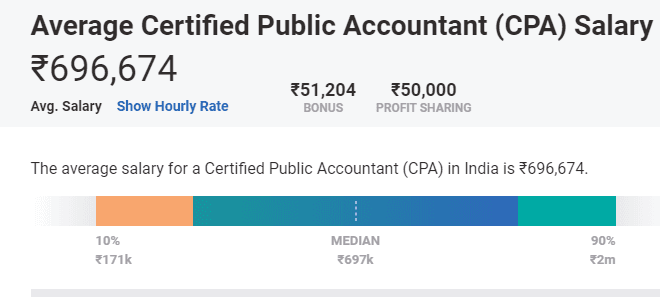

The average salary of CPAs is Rs. 6.9 LPA in India. We hope that this choice has been answered after b. com which course is best.

9. Financial Risk Manager (FRM)

Regarding a recognized degree in banking and finance, the Financial Risk Manager certification is a stellar choice. The GlobThe of Risk Professionals (GARP®) offers the FRM designation as the gold standard in the financial and risk management industry. It signifies your strong grasp of risk management concepts in the ever-evolving financial market. Let’s delve into what makes the FRM certification an exceptional option for post-B.Com aspirants:

Key Highlights of FRM:

- Comprehensive Curriculum: The FRM certification program is designed to arrange an in-depth understanding of risk management, making you a valuable asset in the financial industry. The curriculum covers various aspects of risk, including market risk, credit risk, operational risk, and more.

- Efficient Duration: Unlike some long-term courses, FRM is relatively short and can be completed in nine months. This means you can swiftly acquire the knowledge and skills needed to excel in risk management.

- Two-Part Examination: To become an FRM-certified professional, you must comply with the Program, which includes a two. These exams are typically conducted in May and November, giving you flexibility in your preparation.

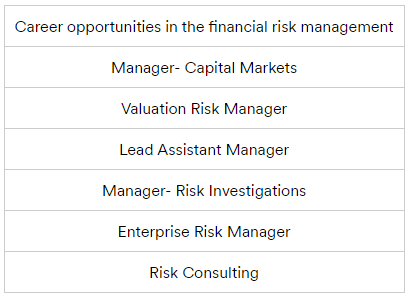

- Diverse Career Opportunities: Earning the FRM designation opens up many career opportunities in the financial industry. Financial Risk Managers are crucial in identifying and analyzing threats to an organization’s assets, earning capacity, and market success. They can work in various roles: sales, private banking, loan origination, credit and market risk analysis, trading, marketing, and financial services.

- Global Recognition: The FRM certification is recognized globally and is highly regarded by employers in the financial sector. It’s a mark of excellence that demonstrates your dedication to risk management.

In Conclusion

For B.Com graduates seeking a career in banking and finance, the FRM certification is a definitive choice. It equips you with the knowledge and skills to navigate the complex world of risk and finance, making you a sought-after professional in the financial industry.

If you’re passionate about risk management and aspire to make a significant impact in the financial sector, FRM is a decision that can lead to a dynamic and fulfilling career. It’s a recognition of your expertise and excellence in risk management.

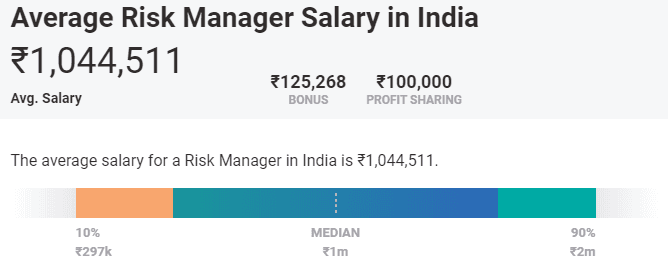

After completing this course, your average earning range will be between Rs 10 – 18 LPA in India.

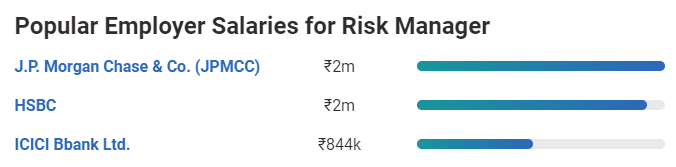

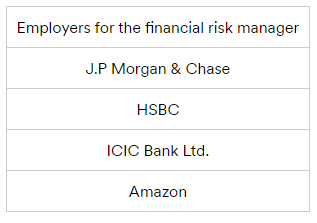

Top employers for Risk Manager in India

Source

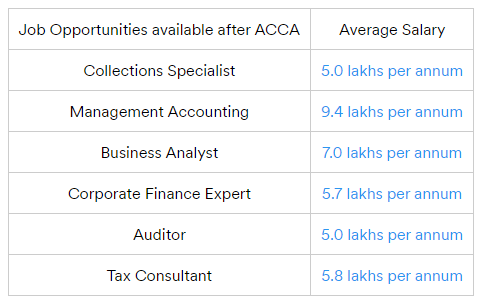

10. Association of Chartered Certified Accountants (ACCA)

Top Companies Hiring ACCA

Source

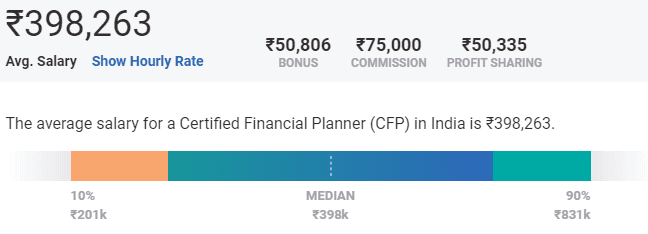

11. Certified Financial Planner

For B.Com graduates seeking a career path that aligns with their financial acumen, the Certified Financial Planner (CFP) certification is a standout choice. With a concise duration of just six months, this Program opens doors to promising career options such as financial consultant and insurance consultant. Let’s explore what makes CFP an excellent choice for post-B.Com career aspirants:

Key Highlights of CFP:

- Diverse Career Opportunities: CFP graduates are well-prepared to embark on careers as financial and insurance consultants. These roles involve providing expert guidance to clients on a large range of financial matters, including investment plans, insurance decisions, tax strategies, and personalized financial advice.

- Holistic Expertise: The CFP certification is a testament to your expertise in various fields, including financial planning, taxes, insurance, estate planning, and retirement. This well-rounded knowledge equips you to address a spectrum of financial needs and offer comprehensive solutions to your clients.

- Four Formal Requirements: To earn the CFP certification, candidates must meet four formal requirements. These include a structured education program, successful performance on the CFP exam, related work experience, and a demonstration of professional ethics. These stringent criteria ensure that CFP professionals are well-equipped to provide high-quality financial guidance.

- Recognition of Excellence: CFP is a mark of excellence in the financial planning industry. It is a testament to your commitment to verifying the highest standards of professional ethics and delivering quality financial advice.

In Conclusion

The Certified Financial Planner (CFP) certification is a compact yet comprehensive program that prepares you for a fulfilling career in financial and advisory. If your passion career is about helping individuals and families achieve their financial goals, CFP is a rewarding choice.

For B.Com graduates who are eager to make a positive effect on the financial well-being of others, CFP is a path that’s well worth considering. This decision can lead to a dynamic and fulfilling financial consultancy and insurance planning career.

The average salary of certified financial planners is Rs. 3.9 LPA in India

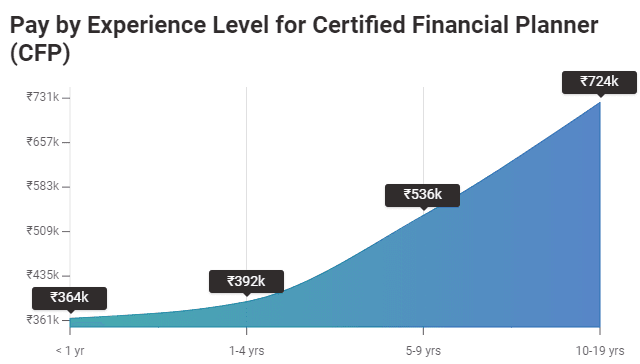

How it increases with years of experience:

12. Certificate in Investment Banking (CIB)

For B.Com graduates aiming for a dynamic and high-paying career, the Certified in Investment Banking (CIB) certification is a top-notch choice. This Program equips you with the expertise to excel in investment banking for six months. Let’s explore what makes CIB an exceptional option for post-B.Com career aspirants:

Key Highlights of CIB:

- High-Paying Career: The investment banker position is considered one of the most profitable career options after B.Com. Professionals in this field are often rewarded with high salaries, making it an attractive choice for those seeking financial success.

- Global Relevance: Investment banking is a rapidly growing field, and certification in investment banking is highly regarded worldwide. The demand for professionals with expertise in raising capital and managing financial transactions is rising, offering many opportunities.

- Comprehensive Curriculum: The CIB certification program is intensive and designed to assess your knowledge, underinvestment banking end, and skills in investment bankers’ various topics, including company valuation, mergers and acquisitions, initial public offerings (IPOs), corporate actions, financial statement analysis, and other critical aspects of investment decision-making.

- Diverse Career Paths: Completing the CIB course opens doors to diverse career opportunities in finance. You can explore roles in investment banking, hedge funds, private equity, equity research, asset management, private wealth management, and corporate finance and strategy. This versatility allows you to begin a career path that aligns with your concerns and goals.

In Conclusion

The Certified in Investment Banking (CIB) certification is your gateway to a prosperous career in investment banking and related fields. It equips you with the knowledge and skills to excel in financial transactions and corporate finance.

Suppose you’re passionate about finance and aspire to significantly impact the world of investment banking. In that case, CIB is a decision that can lead to a dynamic and fulfilling career. It recognizes your expertise and excellence in financial strategy and transaction management.

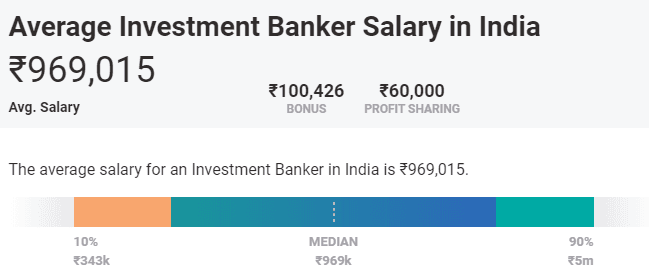

The average salary for Investment Bankers is Rs. 9.6 LPA in India.

How your location affects your pay:

13. Bachelor of Education (B.Ed)

For B.Com graduates seeking a straightforward yet rewarding career path, the Bachelor of Education (B.Ed) is a remarkable option. This 2-year postgraduate teaching program is explicitly designed to enable students to establish an academic career, making it one of the best courses to consider after B.Com. Let’s explore the key aspects of B.Ed and how it can be a fulfilling choice for post-B.Com career aspirants:

Key Highlights of B.Ed:

- Eligibility: To pursue a B.Ed, you typically need to have secured around 50-55% in your Graduation from a recognized university in India. This academic threshold ensures that candidates have a solid educational foundation before starting a teaching career.

- Comprehensive Curriculum: The course structure of B.Ed programs includes a wide range of coursework, covering pedagogy, educational psychology, assessment, educational policy and leadership, instructional technology, social justice, special education, curriculum development, and lesson planning. This comprehensive curriculum provides the knowledge and skills necessary to excel as an educator.

- Career in Academics: After obtaining a B.Ed degree, you can pursue a fulfilling academic career as a teacher or lecturer. Your role will involve educating and guiding students in various subjects, utilizing the knowledge and expertise you’ve gained during your B.Com studies.

- Potential Earnings: While it may seem simple, an academic career can be financially rewarding. Post-completion of your B.Ed degree, you can expect an average annual salary package ranging from Rs. 2.5 to 4 lakhs per annum. This compensation reflects the importance and value of educators in shaping the future.

In Conclusion

The Bachelor of Education (B.Ed) is a straightforward yet impactful choice for B.Com graduates looking to contribute to the field of education. It’s a program that equips you with the necessary skills to educate and inspire the next generation and offers a stable and meaningful academic career.

For those who have a passion for teaching and aspire to make a difference in students’ lives, B.Ed is a decision that can lead to a dynamic and rewarding career as a teacher or lecturer. It’s a recognition of your commitment to education and your dedication to nurturing future leaders.

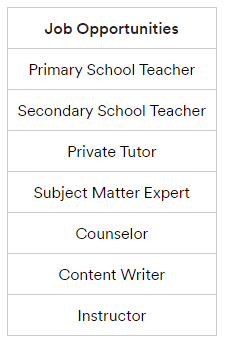

There are a lot of careers one can choose post-completion of B.Ed. Some of those are mentioned below.

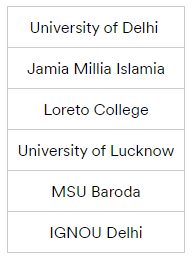

There are numerous options to begin a B.Ed education. Some of those are mentioned below-

The earnings after B.Ed range from 2 lakhs to 7 lakhs per annum.

14. Digital Marketing

For those seeking a creative and dynamic career path, digital marketing is the ideal choice. This field allows you to explore the ins and outs of the digital business world and offers many exciting job opportunities. Let’s delve into what makes digital marketing one of the best courses to pursue after B.Com:

Key Highlights of Digital Marketing:

- Dynamic Industry: Digital marketing is one of the hottest fields, making it a smart choice for post-B.Com education. It introduces you to the ever-evolving digital landscape, equipping you with the knowledge and skills to thrive in this dynamic sector.

- Diverse Job Roles: Digital marketing offers many job roles with attractive annual packages. You can find positions such as digital marketing executive, digital marketing manager, social media marketing expert, SEO executive, content writer, search engine marketer, and many more. This diversity allows you to tailor your career to your interests and strengths.

- Comprehensive Curriculum: Digital marketing courses cover a wide range of topics, including search engine marketing (SEM), social media marketing (SMM), content marketing, search engine optimization (SEO),pay-per-click (PPC) advertising, web design, and more. This comprehensive curriculum ensures you gain expertise in various facets of digital marketing.

- Industry Relevance: As more companies seek to establish their presence in the digital realm, the demand for digital marketing professionals is rising. This field presents promising career opportunities with the potential for growth and advancement.

- Course Duration: Digital marketing courses typically span 3 to 11 months, allowing you to choose a program that aligns with your preferences and time constraints.

In Conclusion

Digital marketing is a captivating and rewarding career choice, not only for B.Com graduates but also for individuals from various educational backgrounds. It offers a chance to be part of the digital transformation and contribute to the success of businesses in the online world.

If you’re eager to explore the limitless possibilities of the digital domain, a digital marketing course can be your gateway to a thriving career. It equips you with the knowledge and skills needed to excel in this dynamic industry and opens doors to various job roles. Digital marketing is the pathway to a future filled with creativity, innovation, and success.

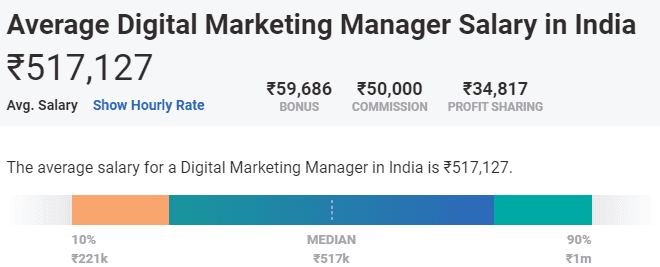

How your pay increases with years of experience:

The Chartered Financial Analyst (CFA

15. Government Exams

Graduates with a background in commerce have a wealth of opportunities when it comes to competitive exams. The subjects studied in commerce programs instill essential numerical and analytical skills, providing graduates with a distinct advantage over other candidates. Let’s explore some of the noteworthy exams that commerce graduates can consider:

- UPSC (Union Public Service Commission): The UPSC conducts civil service examinations, which include the Indian Administrative Service (IAS) and the Indian Revenue Service (IRS), among others. Commerce graduates can compete in these prestigious exams, where success leads to a rewarding and respected career in the civil services.

- CGL SSC (Combined Graduate Level, Staff Selection Commission): The SSC CGL exam is a prominent choice for graduates seeking government jobs. It opens doors to various positions in different government departments, offering competitive salaries and job security.

- PO IBPS (Probationary Officer, Institute of Banking Personal Selection): Commerce graduates can aim for banking jobs through the IBPS PO exam. Successful candidates secure positions as bank probationary officers with the potential for career growth and respectable earnings.

Benefits of These Exams:

Lucrative Salaries: One of the most appealing aspects of these exams is their attractive salary packages. Successful candidates can enjoy competitive remuneration, ensuring financial stability.

Job Security: Government positions obtained through these exams provide job security and stability, which is highly valued in today’s uncertain job market.

Career Progression: Those who pass these exams can look forward to career advancement. They can rise to higher positions with dedication and hard work, earning respect and recognition in their chosen professions.

In Conclusion

For commerce graduates, competitive exams like UPSC, SSC CGL, and IBPS PO provide a clear pathway to prestigious careers with enticing salaries, job security, and opportunities for professional growth. These exams are an excellent choice for those who wish to leverage their commerce education to embark on rewarding and respected career journeys.

16. Insurance

The insurance industry is a significant player in the market, offering a wide range of life and non-life insurance products. Among B.Com students, there is a growing interest in the study of Insurance Management. This field presents numerous opportunities for students to pursue fulfilling careers in various sectors, including audit firms, banks, financial institutions, and insurance companies. Let’s delve into why Insurance Management is gaining popularity and why it’s considered one of the best courses after B.Com:

Key Highlights of Insurance Management:

- Diverse Career Opportunities: Insurance Management opens doors to many career opportunities. Graduates of this Program can explore roles in audit firms, banks, financial institutions, and insurance companies. The diverse options enable you to select a career path that matches your interests and aspirations.

- Industry Demand: The insurance industry is a thriving sector with a constant demand for skilled professionals. This translates to a wealth of job prospects and the potential for career growth.

- Sought-After Course: Insurance Management is becoming increasingly sought after among B.Com students due to the promising career prospects it offers. As the industry continues to expand, professionals with expertise in insurance management are in high demand.

- Professional Growth: Those who pursue a career in insurance management have the opportunity to advance in their professions. Individuals can climb the corporate ladder and achieve professional recognition with dedication and a commitment to excellence.

In Conclusion

Insurance Management is a field that holds great promise for B.Com graduates. It provides a gateway to various career options and is considered one of the best courses to pursue after completing a B.Com degree. As the insurance industry continues to evolve and expand, professionals in this field can look forward to a fulfilling and prosperous career.

17. Wealth Management

Wealth management is a field dedicated to ensuring that organizations provide comprehensive financial services to their clients, supporting them in their financial pursuits. Wealth managers play a vital role in assisting and guiding clients by providing essential account and financial information and offering recommendations for their investment decisions. Wealth management is a compelling option for students uncertain about the best course to pursue after B.Com. Let’s explore the significance of wealth management as a post-B.Com course:

Key Highlights of Wealth Management:

Financial Guidance: Wealth managers are trusted advisors, helping clients make informed financial decisions. They offer insights and recommendations to guide clients’ investment choices and expenditure strategies.

Client-Centric Approach: Wealth management is highly client-centric. It involves tailoring financial strategies to meet individual clients’ unique needs and goals, ensuring a personalized and effective approach to wealth management.

- Strong Career Prospects: As the demand for professional wealth managers continues to grow, pursuing a career in wealth management is an excellent choice for B.Com graduates. The field offers promising job opportunities and financial stability.

- Expertise in Financial Services: Those who enter the world of wealth management gain expertise in various financial services retirement planning, including investment management, estate planning, and tax optimization.

In Conclusion

Wealth management is a dynamic field that offers B.Com graduates a pathway to a rewarding and impactful career. Wealth managers are crucial in helping clients achieve their financial goals by providing valuable financial guidance and strategies. For students looking for the best course to pursue after B.Com, wealth management is an option that combines financial expertise with personalized client service, making it a top choice for those who aspire to excel in the world of finance.

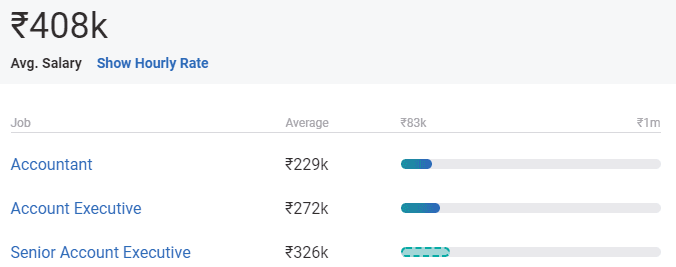

Top job options after B.Com

Some of the best job opportunities after B.Com are-

- Accountant

- Account Executive

- Financial Risk Manager

- Business Analyst

- Digital Marketer

Competitive exams for B.Com graduates

- RBI Grade B Officer

- SBI PO

- LIC AAO

- UPSC CSE/IAS

- SSC CGL

- RRB NTPC

- IBPS Clerk

- IBPS PO

Future Scope of B.com

A B.Com degree equips students with a strong foundation in accounting, economics, taxation, business law, management, and insurance. This wide-ranging knowledge opens up many career opportunities for B.Com graduates. However, it’s essential to note that your choice of Institute significantly shapes your career prospects. Graduates from renowned universities and colleges have better access to high-quality job opportunities. Therefore, selecting the right Institute for your B.Com program is a crucial decision that can impact your future career.

As a B.Com graduate, you can work in the private or public sectors. Additionally, you can pursue advanced roles in the government sector by preparing for exams such as the UPSC or banking examinations. Exploring the various career pathways and job opportunities available to B.Com graduates is essential to ensure a successful and fulfilling career. Being well-prepared will assist you in making informed decisions about higher studies or your job search, ensuring you don’t miss out on lucrative prospects.

The job market continually evolves, creating a steady influx of new employment opportunities every few years. With a B.Com degree, you can qualify for advanced career paths such as Chartered Accountant (CA) and Company Secretary (CS), both highly respected professions.

It’s crucial to invest time in exploring all possible options and reflect on what suits you best after completing your B.Com degree. The current market trends indicate a wealth of career possibilities and jobs for B.Com graduates, supplied they are willing to pursue further studies and stay updated with market trends. Naturally, salaries vary across different fields, starting at 2 LPA and potentially reaching up to 8 LPA, contingent on your skills and experience.

In Conclusion

B.Com graduates have a world of opportunities at their fingertips. By carefully considering your choices and staying attuned to market trends, you can set yourself on the way to a successful and rewarding career. Whether you continue your studies or embark on a job hunt, your B.Com degree is a valuable asset that can open ways to diverse and exciting possibilities.

Conclusion

The list above comprises excellent career options for those wondering, “What to do after B.Com?” It provides insights into potential careers, job prospects, and salary details, helping you make informed decisions about your post-graduation journey.

To determine your career choice after B.Com, consider course duration, difficulty level, and cost. These factors can help you in selecting the ideal path for your aspirations.

Any of the best courses listed above, pursued after B.Com, can lead to rewarding job opportunities and set you on a successful professional career.

For those interested in elevating their careers with an Executive MBA program, upgrade offers an MBA program in collaboration with Golden Gate University.

This program is designed to meet the standards of the best on-campus Executive MBA programs worldwide, providing a high-quality education that can significantly enhance your career prospects.

Your B.Com degree opens doors to a world of possibilities. You can confidently embark on your professional journey after Graduation by carefully considering your interests and weighing the various factors associated with each career option. Whether you pursue a specialized course, enroll in an MBA program, or explore other avenues, the key is to follow your passion and work toward your career goals.