Table of Contents

What Is the Dunning-Kruger Effect?

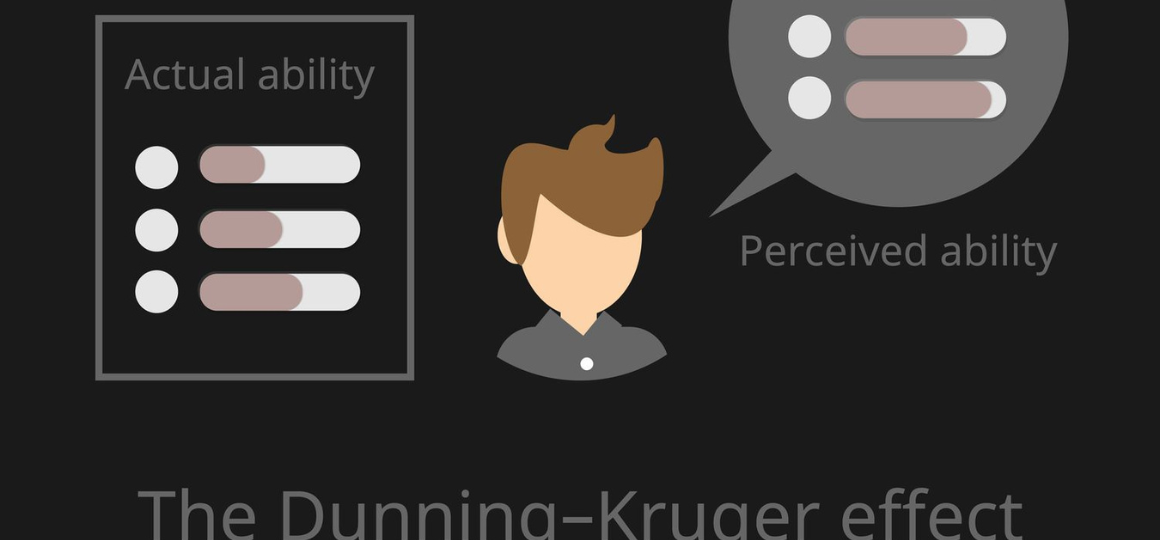

The Dunning-Kruger Effect is a fancy term for when people who don’t know much about something think they know a lot. It was named after psychologists David Dunning and Justin Kruger in 1999.

It means that people who aren’t experts in a certain area often believe they know more than they do. On the other hand, real experts might doubt their knowledge. This is similar to imposter syndrome, where successful people doubt their abilities.

In finance and investing, the Dunning-Kruger Effect can lead to bad decisions. For example, someone might think they’re good at predicting the stock market even if they’re not. This can result in big losses because they take too many risks without understanding what they’re doing.

KEY TAKEAWAYS

- The Dunning-Kruger Effect is when people who aren’t skilled or knowledgeable think they know much more than they do.

- Those who do the worst in tests or don’t know much are usually the ones who think they’re the best and are confident in their wrong beliefs.

- Similarly, skilled or knowledgeable people often doubt themselves, a feeling known as imposter syndrome.

- The Dunning-Kruger Effect was first discussed in a 1999 study and has been proven true in many other studies. It can influence various aspects of life, like how people make decisions about investing.

- Reducing the Dunning-Kruger Effect is possible by learning, training, being open to feedback, and considering objective assessments of your skills and knowledge.

Why the Dunning-Kruger Effect Happens

The Dunning-Kruger Effect happens because of our brains’ limits and our inability to know ourselves well. People who know little about something might not realize they’re not good at it, which can make them think they’re better than they are.

Best Broker For Day Traning

Discover which online brokers offer fast and reliable services at affordable prices. We’ve analyzed the advantages and disadvantages of each to assist you in making the right choice for your daily trading requirements.

LEARN MORE >

But, if someone lacks awareness of their ignorance, they’re likely to think they know more than they do. This is often humorously called “ignorant people not knowing they’re ignorant.” Conversely, experts in a field might doubt themselves as they realize how complex it truly is.

FAST FACT

The idea was first discussed in a 1999 study called “Unskilled and Unaware of It: How Not Knowing Your Incompetence Makes You Think You’re Better” by social psychologists David Dunning and Justin Kruger.

Another reason this happens could be because some people don’t realize or think carefully about how good they are at something. This is called “metacognition.” If someone always thinks they’re better than they are, they might not listen to feedback that could help them improve.

Also, people might judge their abilities based on their feelings rather than on clear standards.

The researchers found that people who aren’t very good at something are likelier to think they’re great at it. On the other hand, people who are good at something might not realize just how good they are. This creates a curve that goes up and then down when you compare how good people think they are with how good they are. Dunning and Kruger looked at how good people thought they were at things like being funny, thinking logically, and using English correctly.

Important: The Dunning-Kruger Effect is a way our brains can trick us, just like many other ways our minds can lead us to make bad choices about money. These tricks include things like believing what’s familiar, feeling uncomfortable when we think one thing but do another, only looking for information that supports what we already think, sticking too closely to what we’re used to, favoring investments from our own country, getting stuck on the first piece of information we hear, and valuing things more just because we own them.

In a study about grammar, college students took an American Standard Written English test. Afterward, they judged how good they thought they were at grammar and how well they expected to do on the test. Those who scored the lowest on the test thought they were better at grammar and expected to do better on the test than they did. On the other hand, those who scored the highest underestimated their grammar skills and their test scores.

To understand the Dunning-Kruger Effect, researchers compare how people rate their abilities (subjective) with how well they perform (objective). A 2008 study repeated the original findings, showing that people who performed poorly expected much higher scores than they got. Those in the middle expected to do better than they did, while those who did the best expected to do worse. Other studies have also found similar results in different situations.

Tip: Dunning and Kruger discovered that as someone gets better at something, they become more accurate in judging their abilities. This means that the difference between how good they think they are and how good they are gets smaller over time.

Impact of the Dunning-Kruger Effect

The Dunning-Kruger Effect impacts people in business, finance, medicine, and politics. It can cause them to make bad and less effective decisions, leading to negative results.

Dunning-Kruger Effect in the Workplace

The Dunning-Kruger Effect can occur when employees take on tasks they’re not ready for or make decisions without understanding the consequences. People affected by this might not listen to feedback because they’re too sure of themselves, which can prevent them from growing and working well with others.

One problem is that hiring managers might hire the wrong people because they seem confident in interviews, even if they’re affected by the Dunning-Kruger Effect. Similarly, these employees might get promoted for the same reason.

Dunning-Kruger Effect On Business and Finance

The Dunning-Kruger Effect can greatly impact how people make financial decisions and invest their money. New investors might think they’re better at picking stocks or predicting market trends than they are, which can lead to bad investment decisions and losing money. They might also miss seeing risks that could hurt their investments.

People who think they know more than they do might not listen to experts like financial advisors, especially if the advice doesn’t match what they already believe.

Dunning-Kruger Effect in Medicine

In the medical field, the Dunning-Kruger Effect can make healthcare workers think they know more than they do. This can cause them to make mistakes when diagnosing illnesses or deciding on treatments. These errors might lead to missing important diagnoses or not ordering the right tests, which can delay treatment or even result in the wrong diagnosis. These mistakes can have serious effects on patient’s health and care.

How to Avoid the Dunning-Kruger Effect

To prevent the Dunning-Kruger Effect, it’s important to listen to different opinions, understand your limits, and be open to feedback. It’s not easy, but being humble and realistic about what you know can help you avoid making big mistakes.

Talking to coworkers, mentors, and experts can help you better understand your skills and knowledge and avoid costly errors. Don’t assume you’re better than people with more training and experience. Education and training are the best ways to become an expert.

Healthcare organizations can set clear rules for decision-making and encourage professionals to work together and share what they know. This helps ensure everyone makes informed choices and learns from each other.

FAQs

1. What is the ‘double curse’ of the Dunning-Kruger Effect?

Ans: The “double curse” of the Dunning-Kruger Effect happens when.

- People with low skills often think they’re much better than they are.

- Highly skilled individuals often underestimate their abilities or knowledge.

2. Is the Dunning-Kruger Effect real?

Ans: Since the original study by Kruger and Dunning in 1999, many other studies have found similar results, showing that the Dunning-Kruger Effect is real in different areas. However, some experts have criticized how the original study was done and said that the idea is used too much in situations where it might not apply. Despite these criticisms, most people still believe that the Dunning-Kruger Effect affects how people think about their skills and knowledge.

3. What is the opposite of the Dunning-Kruger Effect?

Ans: While there isn’t a direct opposite of the Dunning-Kruger Effect, there’s something called imposter syndrome. This happens when skilled and trained people feel like they don’t deserve their success and worry they’re frauds. It makes them doubt themselves, feel anxious, and fear others finding out they’re not as good as they seem.

4. Who is most susceptible to imposter syndrome?

Ans: Impostor syndrome can impact anyone, no value of what they do, where they’re from, or how successful they are. While it’s often linked with people who achieve a lot, strive for perfection, or work in competitive settings. They might doubt themselves even though they’re good at what they do. Yes, even though they’re good at what they do.

The Bottom Line

Discovered in 1999 by psychologists, the Dunning-Kruger Effect explains how people with low skills or knowledge often think they’re better than they are, while those who are skilled tend to doubt themselves.

This effect affects many areas, like business and investing. It can lead to bad hiring choices, too much confidence, bad investment strategies, and taking too many risks. To avoid it, people can learn more about a topic, listen to advice from experts, and be open to new ideas.

Trade on the Go. Anywhere, Anytime

Get started with one of the biggest crypto exchanges in the world! Enjoy low fees and great customer support while trading safely. Plus, you’ll get access to Binance tools to track your trades, manage auto-investments, check prices, and convert with no fees. Sign up for free and join millions of traders worldwide on the crypto market.