The financial industry has seen significant advancements in the last decade, with the introduction of big data technology playing a crucial role in driving these changes. Big data has transformed how businesses operate, manage risk, and analyze customer behavior. In this report, we will discuss the role of big data in shaping the financial industry and the benefits it offers.

Introduction

The financial industry renders vast amounts of data daily. This data includes information about customer transactions, market trends, and investment patterns. With the advent of big data technology, financial institutions can now collect, process, and analyze this information at unprecedented speeds and volumes. This has enabled banks, insurance companies, and other financial institutions to gain valuable insights into customer behavior, market trends, and potential risks.

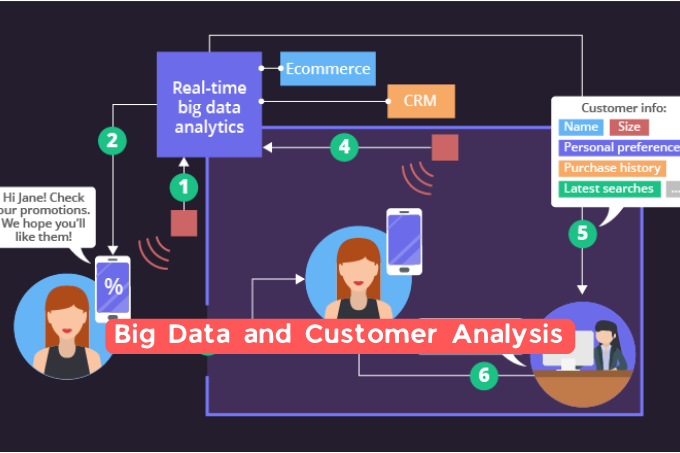

Big Data and Customer Analysis

One of the essential advantages of big data in the financial industry is its ability to analyze customer behavior. Financial institutions can gain insights into customer’s behavior and preferences by collecting and analyzing data on customer transactions and interactions. This information can help banks and other financial institutions develop personalized products and services that meet the specific needs of their customers.

Big Data and Risk Management

Big data technology also plays a crucial role in risk management. Financial institutions can use big data to identify potential risks and vulnerabilities in their systems, allowing them to take proactive measures to prevent fraud and other security breaches. In addition, big data can help banks and insurance companies identify trends and patterns that may indicate potential risks in the market, enabling them to adjust their strategies accordingly.

Big Data and Investment Analysis

Big data has also revolutionized the way financial institutions analyze investments. Financial institutions can make more informed investment decisions by analyzing vast market data in real-time. This can help them identify opportunities and mitigate risks, improving their overall investment performance.

Big Data and Fraud Detection

One of the most significant advantages of big data in the financial industry is its ability to detect fraud. Financial institutions can identify patterns and anomalies that may indicate fraudulent activity by analyzing vast amounts of data. This allows them to take proactive measures to prevent fraud before it occurs.

Big Data and Compliance

Big data technology has also enabled financial institutions to comply with regulatory requirements more efficiently. By automating compliance processes and monitoring transactions in real-time, banks and other financial institutions can ensure that they comply with regulatory requirements and avoid potential penalties.

Conclusion

Big data technology has revolutionized the financial industry, providing financial institutions with unprecedented data and insights. The benefits of big data in the financial industry are numerous, from improved customer analysis to more effective risk management and fraud detection. As the amount of data generated by financial institutions continues to grow, the role of big data in shaping the financial industry will only become more critical.

FAQs

1. What is big data in the financial industry?

Big data refers to vast amounts of structured and unstructured data from financial institutions. This data can be investigated to gain insights into customer behavior, market trends, and potential risks.

2. How does big data help with risk management in the financial industry?

How does big data help with investment analysis in the financial industry? By analyzing vast amounts of market data in real-time, financial institutions can make more informed investment decisions, identifying potential opportunities and mitigating potential risks.

3. How does big data help with investment analysis in the financial industry?

By analyzing vast amounts of market data in real-time, financial institutions can make more informed investment decisions, identifying potential opportunities and mitigating potential risks.

4. What is the role of big data in compliance in the financial industry?

Big data technology has enabled financial institutions to comply with regulatory requirements more efficiently, automating compliance processes and monitoring transactions in real time.

5. How does big data help with fraud detection in the financial industry?

The future of AI in finance looks promising, with continued advancements in AI technology expected to revolutionize the financial industry in numerous ways.